MATH 375 Stochastic modelling in insurance and finance

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

MATH 375

Stochastic modelling in insurance and finance

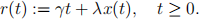

1. Let α.β.γ.λ.α0.be given positive constants, and  a standard Brownian motion under the risk-neutral probability measure

a standard Brownian motion under the risk-neutral probability measure  be the solution to the following equation:

be the solution to the following equation:

Consider the following interest rate model:

i) Can the process (r(t).t > 0) take a negative value for some t > 0? Justify your answer. [6 marks]

ii) Derive the price p(t.T) of the zero-coupon bond at time t ∈ [0, T]. [9 marks]

iii) Let α = 1, β = ,3, γ = 1, λ = 1, α0 = 0.03. Consider a forward contract on the zero-coupon bond of part (ii) with maturity T = 1, the delivery date of which is T1 = 0.5 and the delivery price is K = 0.5. Find the value of this forward contract at time ≠ = 0 for the holder with a short position. [10 marks]

2. State the three types of recovery rules for the intensity based credit risk models. If the intensity is constant, i.e. γ(t) = λ > 0 for all t > 0, then what is the expected value and the variance of default time ≠ under the risk-neutral probability measure? [8 marks]

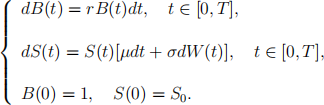

3. Consider a market of a bank account B(≠) and a stock s(≠), that satisfy the equations:

Here γ.μ.σ.S0 are known positive constants, and (W (t).t ∈ [0, T]) is a standard Brownian motion. Let 0 < K1 < K2 be two given constants. Consider a contract with the following terminal payoff:

Find the price X(t) at time t ∈ [0, T] of this contract. [17 marks]

2022-01-12