FIN3020 - Assignment 2023-2024

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Fixed Income Instruments

FIN3020 - Assignment

guidelines

2023-20241

Outline

Use Bloomberg, S&P Capital IQ and other appropriate resources to write a report about the debt of a publicly listed company of your choice.

The deadline for submission of this assignment is 17:00 on 13th March.

Details

Part 1

While you may select any publicly listed company, you are advised to select a company that is well-known, has a non-trivial debt structure, and for which you can readily obtain a range of data over a reasonable time period. Equally, you may wish to avoid companies with overly-complicated capital structures.

Part 2

Compose a report on the company. The report should comprise of the following sections:

1. Introduction - a brief summary of the nature of the company’s business.

2. Debt Profile - a description of the total debt, maturity profile, security types, holders, etc.

3. Yield Analysis - a historical perspective on the cost of debt relative to appropriate bench-marks.

4. Credit Risk - a description of the company credit rating and how this has changed over time.

5. References in Harvard style

Your discussion should include at least one reference to an article written by a respected source of financial journalism that helps to explain observed phenomenon in the market data. The report should be no more than four A4 pages in total (including all references). You are free to format the report in any manner you choose.

Part 3

Save your report in PDF format (in Word use the ‘Save as’ option). Upload your completed report to Canvas.

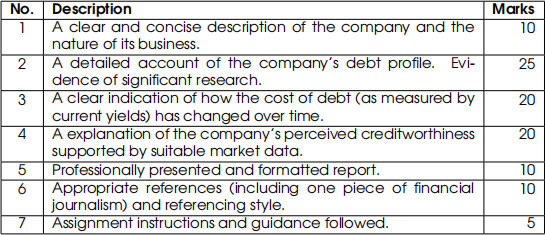

Mark Scheme

Marks will be awarded based on the following scheme and criteria.

Important Notes

• If you are unfamiliar with academic referencing, please first complete the short training course provided here: www.qub.ac.uk/cite2write. Use the reference generator to create appropriately formatted references. All online references should include the URL and date of access.

• Consider using charts and tables to present information.

• No marks will be awarded for screen shots taken from third party sources. All charts and tables should be your own.

Academic Conduct

• Academic honesty is fundamental to the values of Queen’s and the University takes any instances of academic misconduct very seriously. Students should not be allowed to obtain for themselves, or for anyone else, an unfair advantage as a result of academic dishonesty and, when discovered, the Procedures for Dealing with Academic Offences (including research misconduct) will be invoked. http://www.qub.ac.uk/cite2write/ is a good resource for guidelines around plagiarism.

• To aid the organisation of group coursework it is implied that you consent to having your name and QUB email address distributed to classmates. If this is not the case please contact me.

Bloomberg

While not an exhaustive list, you may wish to consider the following Bloomberg functions:

• CAST - capital structure

• DDIS - debt distribution

• HDS - company debt tab

• CRPR - credit rating profile

• DRSK - default risk

• CDSV - CDS curve

Bloomberg terminals in the Trading Room can be used without reservations (no book in advance is required). You can check the timetable and find the available time slots via the online timetable: https://www.qub.ac.uk/schools/QueensManagementSchool/ About/FinTrUTradingRoom/Timetable/

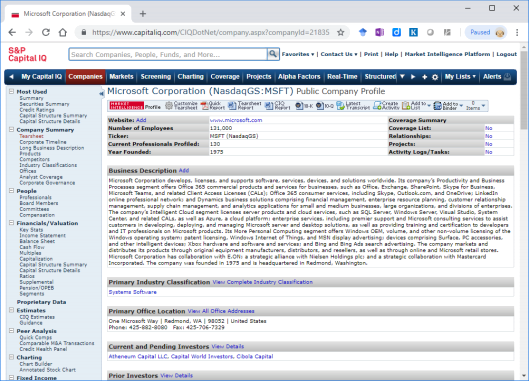

S&P Capital IQ

S&P Capital IQ is a financial database that Queen’s Management School students now have ac-cess to. Follow the link from: http://libguides.qub.ac.uk/management/businessdatabases.

You will need to register with your QUB email address to get access.

Once logged into S&P Capital IQ, first search for a company. Once you have selected a company, use the menu on the left hand side to access further information. In particular you should explore the various items under the ‘Fixed Income’ sub heading.

For newly issued bonds you may be able to find r elated d ocumentation s uch a s t he indenture or underwriting agreement. These documents provide key insights for investors and will provide valuable content for your report.

Pre-Assignment Feedback or ‘Feed-forward’

This pre-assignment ‘feedback’ is based upon selected observations from similar assignment sub-missions from previous years. Note that this feedback should not be considered definitive: following the advice is no guarantee of success. However, it will allow you to improve your own submission and avoid common problems.

Good Submissions/Examples of Good Practice

• Report is clearly organised, well structured and lacking in obvious mistakes.

• Written in a concise professional style focusing on key information for the decision maker (i.e. investor).

• Consistent use of formatting giving the document an easy to follow structure.

• Page limit respected.

• Evidence of extensive investigation using both quantitative and qualitative information.

• Care taken to create well-formatted and uncluttered visualisation of data (following the necessary and sufficient principle).

• Made appropriate use of financial terminology.

• Used appropriate benchmarks to provide context.

Poor Submissions/Examples of Poor Practice

• Excessive quotes from external sources.

• Incomplete referencing.

• Information provided without context or discussion.

• Poor formatting of tables (e.g. inconsistent formatting, numeric data not right aligned).

• Made no attempt to standardize the formatting of the document giving it an unpro-fessional appearance.

• Beware logical follies. For example, just because a rise in demand would normally lead to a rise in price, does not mean that a rise in price is always caused by rise in demand.

• Use of poor resolution screenshots!

2024-04-03

Fixed Income Instruments