LUBS2610 Week 10 Mock Exam Revision Lecture Questions

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

LUBS2610 Week 10 Mock Exam Revision Lecture Questions

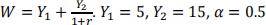

1. A two-period economy is characterised by a representative consumer with a utility function,  , and their present discounted value of lifetime income is,

, and their present discounted value of lifetime income is,  and the interest rate in the economy is zero for everyone. Using the Lagrangian method, derive the optimal consumption choice for the representative consumer, explain your steps, and state whether the consumer is a lender or a borrower. Starting from this this result, explain and discuss the theory of Ricardian Equivalence, and whether its predictions about the size of the government spending multiplier are supported by empirical research.

and the interest rate in the economy is zero for everyone. Using the Lagrangian method, derive the optimal consumption choice for the representative consumer, explain your steps, and state whether the consumer is a lender or a borrower. Starting from this this result, explain and discuss the theory of Ricardian Equivalence, and whether its predictions about the size of the government spending multiplier are supported by empirical research.

2. Two identical economies begin where actual output is equal to potential output. Economy A experiences a positive demand shock due to a fall in the risk premium, Economy B experiences an equivalent negative demand shock due to a rise in the risk premium. Explain the problem faced by a central bank of asymmetric demand shocks in a currency union. Discuss how fiscal transfers or labour mobility can be used to address asymmetric demand shocks. Including the distributional implications between and within economies, what are the costs and benefits of each approach to addressing asymmetric shocks? Is the European Monetary Union more or less likely to have problems with asymmetric demand shocks over time?

2023-12-26