BUSM107 FINANCIAL ANALYSIS AND MANAGEMENT ACCOUNTING COURSEWORK

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

BUSM107 COURSEWORK

FINANCIAL ANALYSIS AND MANAGEMENT ACCOUNTING COURSEWORK

DEADLINE: 9th JANUARY 2024 ON QMPLUS

Instructions:

Please read carefully the case study PB provided as pre-seen material on BB and answer the following questions. Deadline: 9th January 2024.

Requirements: Please answer the following questionsregarding the case study, using the material from the lectures/seminars of BUSM107. Special attention will be given to answers so they include the content from the lectures. There are 5 questions and each question needs to be answered in your report in 500 words. Overall, the word count is 2,500 words +/- 10% and this excludes any references.

Question 1- Leasing and activity-based costing

It is 15 January 2024. Personal Best (PB)’s Senior Management Team (SMT) is pressing ahead with its plan to launch the company’s vegan range of protein bars and protein powders. The vegan range will be branded as PB-V and is set to be launched in April 2024.

You have the following conversation with Akida Agu, Finance Manager:

“To protect PB-V’s vegan and lactose-free status, the new range must be manufactured in a separate production facility. The SMT has already sourced a nearby building that can be used for this purpose.

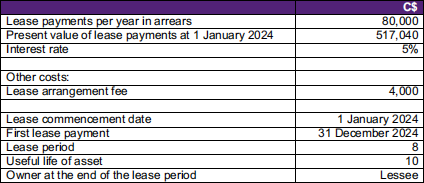

Ben Morales, Production Director, is eager to use state-of-the-art machinery in the new facility. The machinery includes robotic arms and production machinery capable of being integrated with our production, inventory, purchasing and sales ordering systems. To conserve cash, Ben obtained a quote from a company willing to lease the machinery for the new facility. I have attached this quote to this email (Exhibit 1).

I have a meeting with the SMT later today regarding PV-V. Could you assist me by preparing a briefing note which explains the following:

• How the lease will initially be recorded in our accounting records and how it will be treated in our financial statements for the year ended 30 June 2024 and in subsequent years. (sub-task (a))

The manufacturing process for the vegan range will be similar to our existing range. However, the vegan production line will require two inspectors to be recruited full-time. The inspectors are required by law and will carry out routine tests to ensure that products are 100% vegan and lactose-free. In addition, instead of packing finished bars into boxes manually, robotic arms will perform this task instead.

The SMT had initially intended that facility-wide rates based on machine hours would be used for the variable and fixed production overhead absorption rates. However, one member of the SMT has suggested that activity-based costing (ABC) might be a more appropriate costing method for the new PB-V range. At the moment, the SMT is unsure if ABC is a suitable costing method for the new range.

In your briefing note, could you include the following please:

• Explain the factors that should be considered when deciding whether ABC would be a suitable costing method for the new PB-V range. (sub-task (b))”

Reference materials

Exhibit 1 – Leasing quote for machinery

Question 2- What-if analysis

It is now 15 February 2024. The new production facility and machinery are set to be ready for use on 1 April 2024. With the development of the facility on track, the SMT is focusing its attention on other matters related to the PB-V range.

You receive the following email from Akida Agu, Finance Manager:

From: Akida Agu, Finance Manager

To: Finance Officer

Subject: What-if analysis

I’ve been working closely with the SMT on the budgets for the PB-V range. The SMT has already approved my budget for the PB-V protein powders. However, the SMT would like a further analysis of the PB-V protein bar budget.

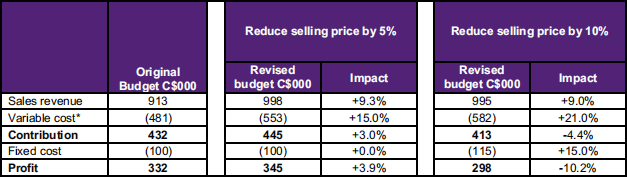

I’ve created a PB-V protein bar range budget based on a proposed selling price of C$21 per box of bars. The SMT has asked to see the impact of reducing this selling price by 5% and by 10%. I have prepared a what-if analysis (Exhibit 1) that shows how the price changes would impact sales volumes and fixed costs.

I have a meeting coming up with the SMT. I’m in a rush today, so could you assist me by writing a briefing note which explains:

• The impacts of the changes to the selling price on budgeted revenues, contributions and profits for PB and the factors we should consider before either of the changes are implemented. (sub-task (a))

Akida Agu

Finance Manager

Exhibit 1 – What-if analysis: Impact of decreases in selling prices on the PB-V protein bar range budget for 1 Apr to 30 Jun 2024

*Note – This analysis was prepared under the assumption that the variable cost per unit will not change when the selling price change s.6

Question 3- Relevant costing, short-term investments and financial reporting issues

Is it now 5 July 2024. The SMT has concluded that while the production facility could be performing better, demand for the PB-V range shows that the product is likely to be a commercial success, and sales have far exceeded expectations.

You have the following conversation with Akida Agu, Finance Manager:

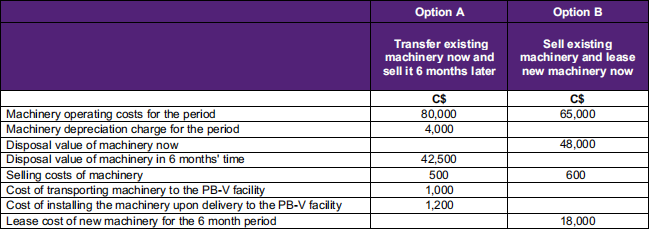

“Sales for our PB-V range have been exceptional. To keep up with demand, Ben Morales, Production Director, has suggested transferring an old mixing machine from our original facility to our new facility.

There are two potential options for this transfer. Option A involves transferring the machine and using it for six months. At the end of the six months, we would lease a new mixing machine that is larger and more efficient. Option B involves leasing the larger, more efficient mixing machine and selling the existing machine now. I have attached some financial information relating to this (Exhibit 1).

I have a meeting with the SMT later on. Could you draft me a report before the meeting that explains:

• How the figures shown in Exhibit 1 would be used to make a decision on whether to choose Option A or Option B, giving reasons why each item is relevant or irrelevant to the decision. (sub-task (a))

If trends continue, the exceptional demand for our PB-V range will lead to a short-term cash surplus in a month. The SMT has noted that they would like to consider short-term investment opportunities for this cash.

In your report, could you also include an explanation of:

• The factors that we need to consider when choosing short-term investments and two suggestions of suitable short-term investments for the surplus cash. (sub-task (b)

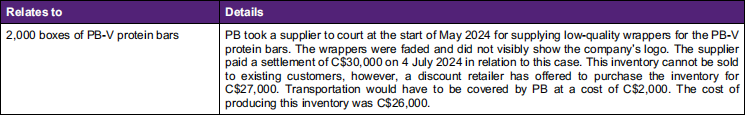

Finally, we are preparing the financial statements for the year ending 30 June 2024. We have a legal issue that I believe could have an impact on these financial statements. I’ve attached the details of this issue to this email (Exhibit 2).

In the report, could you include a commentary that explains:

• How to reflect the court case settlement and the 2,000 boxes of PB-V protein bar inventory in our financial statements for the year ending 30 June 2024. (sub-task (c) )”

Exhibit 1 – Financial information regarding the options for transferring machinery

Exhibit 2 – Legal issue

Question 4- Variance analysis Budgeting techniques and Suppliers Relationship

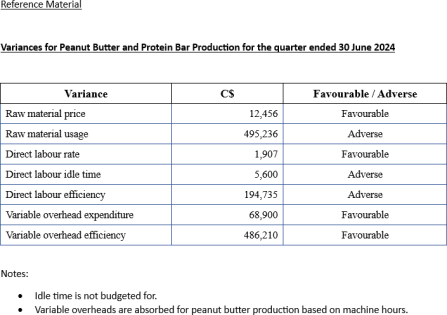

Is it now 20 September 2024. The Senior Management Team (SMT) has requested a report on the production expense variations of protein bars over the last quarter. That includes the manufacturing of peanut butter and the protein bars themselves.

You have the following conversation with Akida Agu, Finance Manager:

“I have attached the variances, which have been calculated by one of our Finance Assistants. (Reference Material). I have also collected some information regarding some incidents which occurred over the last quarter. They are as follows:

• A machine used for the shelling of peanuts developed a fault where a significant quantity of peanuts was lost along with the removed shells.

• The fault was discovered after 10 days, at which point it was estimated that a further 6 days would be needed to complete the repair. Thus, the machine was idle for 6 days.

• After the inventory of shelled peanuts was exhausted, some production employees were idle for 2 days.

• The Head of Peanut Butter Production made a decision to form a team of employees to shell the peanuts by hand until the repair was effected. This was an additional process not usually done by employees.

• Whey powder prices in the market have dropped slightly over the last 3 months.

• The solar energy generation system was able to generate more electricity than usual due to strong sunlight intensity. Thus, less energy was purchased from the electricity grid.

Please prepare a report to the SMT which explains:

• The potential causes for each of the variances and any linkages between the causes of the variance. (Subtask(a))

It seems to me that the costs of production have been on the rise over the past year or so. It also seems to me that we are getting haphazard outputs from our variances, and I am wondering whether traditional budgeting is a bit too restrictive. I have been reading about beyond budgeting, and I think it would be a good idea to use a beyond budgeting approach in the business.

Please prepare a briefing paper for me explaining:

• The characteristics and benefits of ‘beyond budgeting’ with regard to our current circumstances.(Subtask (b))

On a different note, we have just received a communication from our peanut supplier where he has mentioned difficulties in supplying our last order on time. To be specific, he says he is unable to deliver the required quantity on the specified date and suggests placing larger orders well in advance as a solution in the future. Fortunately, this particular incident will not halt our production as we have some leftovers from the current quarter in addition to our buffer inventory. However, in the future it could cause a serious disruption to our production schedules. The solution proposed by the supplier means that we would have to place one single order for the requirement of peanuts for the quarter and it would create some issues with the EOQ model which we have been using to place orders.

I would have to discuss the above matter and possible solutions as well during the Board Meeting. Therefore, could you please include the following in the briefing paper:

How can we strengthen our relationship with the supplier? Also please mention whether we need to look at sourcing from other suppliers and how we could do so if needed? (Subtask (c))

Question 5- Financial Reporting; Investment Appraisal and Zero Based Budgeting

Is it now mid November 2024. The Finance Manager stops by your workplace and says the following.

Hi,

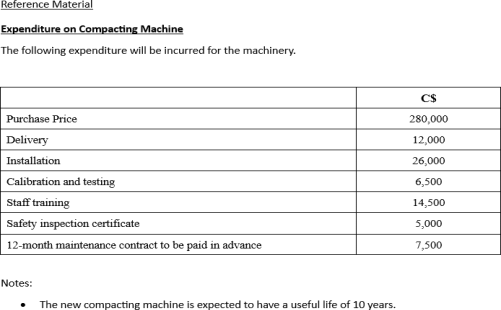

I’m going to let you in to a secret today. The Board has confirmed that the launch of the new Protein Biscuit range is a certainty. The launch is scheduled for mid-April 2024. We have been asked to make the preliminary evaluations with regard to purchasing the necessary equipment. I have obtained quotations from several manufacturers for a compacting machine which will be an integral part of the biscuit-making process. Here is a breakdown of the estimated costs of acquiring the machine and related expenses (Reference Material).

Julia states that the financing required for the project is already secured, and we will be getting the cash within the coming month. This means a significant increase in the cash balance in the short term as the bulk of the payments for the project will be made within a month or two of the product launch. A short-term investment is being considered to make productive use of the cash until it is required.

Could you please drop me an email covering the following:

Provide an explanation of the criteria for capitalisation of cost under IAS 16 Property, Plant and Equipment and whether the purchasing of the compacting machine would meet these criteria. Please also explain the treatment, as either capital or revenue expenditure, for each of the costs in the list based on the requirements of IAS 16.

(Subtask (a))

What should be considered when choosing a short-term investment and what are some short-term investment opportunities that we could consider?

(Subtask (b))

Another matter that will be discussed at the SMT will be the proposed launch of a new protein biscuit range in April 2024. Ben reported that employee morale is low in the production facility. He believes unless we motivate our staff, it will not be possible to launch the biscuit range as planned. With the staff cadre at 159, Ben proposed that PB set up an HR department to address employee issues. In the interim, he proposes to set up an on-site café to provide refreshments to all employees at subsidised rates. This on-site café could be either inhouse operated or outsourced. I discussed this matter with Julia Mathews, Finance Director and she suggested that a zero-based budgeting (ZBB) approach be used to create a budget for this activity.

Please prepare a briefing paper on how a ZBB approach can be applied to create a budget for the proposed new on-site café. Also, discuss two benefits and two challenges that we might face when using a ZBB approach to create this budget.(Subtask (c))

2023-12-26