MANG2015W1 FINANCIAL MANAGEMENT SEMESTER 1 MID-TERM TEST 2018-19

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

MANG2015W1

SEMESTER 1 MID-TERM TEST 2018-19

FINANCIAL MANAGEMENT

DURATION: 90 MINUTES (1.5 HOURS)

SECTION A

You must answer ALL questions from this section.

Each question is worth 1 mark

1. Failure to meet short-term current liabilities takes the firm

closer to

A. Nothing

B. Breakeven situation

C. Maximum profit

D. Bankruptcy

2. Which of the following is correct?

A. The capital asset pricing model predicts that a security with a beta of zero will provide an expected return of zero.

B. lnvestors demand higher expected rates of return on stocks with more variable rates of return.

C. lnvestorsdemand higher expected rates of return from

stocks with returns that are very sensitive to fluctuations in the stock market.

D. The capital asset pricing model is formed as

R=Rf+betaxRm

3. What is the book value per share for a firm with 2 million

shares outstanding at a price of $50,a market-to-book ratio of .75, and a dividend payout ratio of 50%?

A. $33.33

B. $37.50

C. $62.50

D. $66.67

4. When a firm's debt-equity ratio is 1.0,the firm:

A. has too much long-term debt in relation to leases. B. has less long-term debt than equity.

C. is nearing insolvency.

D. has as much in long-term liabilities as inequity.

5. Which of the following is correct:

A. Compound interest pays interest for each time period on

the original investment plus the accumulated interest.

B. The present value of an annuity due equals the present

value of an ordinary annuity times the discount rate.

C. A dollar tomorrow is worth more than a dollar today.

D. For a given amount, the lower the discount rate, the less the present value.

6. What is the lRR of a project that costs $100,000 and provides cash inflows of $17,000 annually for 6 years?

A. 0.57%

B. 2.00%

C. 5.69%

D. 56.87%

7. Which of the following investment criteria takes the time value of money into consideration?

A. Net present value

B. Profitability index

C. lnternal rate of return for borrowing projects

D. All of these

8. According to the NPV rule, all projects should be accepted if

NPV is positive when discounted at the:

A. internal rate of return.

B. opportunity cost of capital.

C. risk-free interest rate.

D. accounting rate of return.

9. When a project's internal rate of return equals its opportunity cost of capital, then:

A. the project should be rejected.

B. the project has no cash inflows.

C. the net present value will be positive.

D. the net present value will be zero.

10. What is the percentage return on a stock that was purchased for $50.00, paid a $3.00 dividend after one year, and was then sold for $49.00?

A. -2.50%

B. 2.50%

C. 4.00%

D. 7.50%

11.Why is debt financing said to include a tax shield for the company?

A. Taxes are reduced by the amount of the debt.

B. Taxes are reduced by the amount of the interest.

C. Taxable income is reduced by the amount of the debt.

D. Taxable income is reduced by the amount of the interest.

12. Which of the following statements is incorrect concerning the equity component of the WACC?

A. There is atax shield such as with debt.

B. The value of retained earnings is not included.

C. Market values should be used in the calculations. D. Preferred equity has a separate component.

13. lf a firm earns the WACC as an average return on its average -risk assets, then:

A. equity-holders will be satisfied, but bond-holders will not.

B. bond-holders will be satisfied, but equity-holders will not.

C. all investors will earn their minimum required rate of return. D. the firm is investing in only positive NPV projects.

14. Which of the following is a source of cash for a firm? A. Retained earnings

B. Borrow money from the bank

C. lssuing new equity

D. All of these

15. What would you expect to be the market price of stock after a sold-out rights issue if each existing shareholder purchases

one new share at $60 for each three that he or she currently holds and the current share price is $100?

A. $75.00

B. $80.00

C. $85.00

D. $90.00

SECTION B

You must answer TWO questions from this section.

Each question is worth 2.5 marks

1. What is the minimum cash flow that could be received at the end of year 3 to make the following project "acceptable"?

lnitial cost = $100,000; cash flows at end of years 1 and 2 = $35,000; opportunity cost of capital = 10%.

2. At current prices and a 13% cost of capital,a project's NPV is $100,000. By what minimum amount must the initial cost of

the project decrease (revenues will be unchanged) before you would wait 2 years to invest?

3. What is the value now for an investor starting with $1,000 in

common stocks over a 20-year investment horizon in which

stock returns are 11% in nominal terms? What about when the stock returns are 4% in real terms?

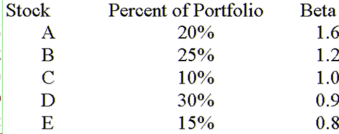

4. Calculate the expected rate of return for the following portfolio, based on a Treasury bill yield of 4% and an expected market return of 13%:

2023-12-13