FIN 320 Fall 2023 PROBLEM SET # 1

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

FIN 320

Fall 2023

PROBLEM SET # 1

Question 1

Consider the following three stocks:

a) Stock A is expected to provide a dividend of $10 a share forever (starting next year);

b) Stock B is expected to pay a dividend of $5 next year. Thereafter, dividend growth is expected to be 4% forever;

c) Stock C is expected to pay a dividend of $5 next year. Thereafter, dividend growth is expected to be 20% per year for 5 years (i.e., until year 6) and zero thereafter.

If the appropriate interest rate to discount the cash flows is 10% per year for all stocks, which stock is the most valuable? What if the appropriate interest rate is 7% per year?

Question 2

Phoenix Motor Corp was hit by a crisis four years ago and stopped paying dividends. Now, Phoenix Motor Corp. has just announced a $1 per share dividend. Dividends will increase to a “normal level” of $3 when the company completes its recovery over the next three years. After that, dividend growth will settle down to a moderate long-term growth rate of 6%. Assume dividends of $1, $2 and $3 for years 1, 2, 3.

Phoenix stock is selling at $50 per share. Write down an equation from which the interest rate being used to discount Phoenix’s future dividends can be solved. If you are able to solve it using a computer (Excel, matlab, etc.), do it! Don’t worry if you can’t, just provide a guess.

Question 3

Longs Drug Stores will pay dividends of $0.56 per share and trade at $45.50 per share at end of one year. Suppose the appropriate interest rate to discount Longs Drug cash flows is 6.80% per year. What is the price of Longs Drug share today?

Question 4

Crane Sporting Goods will have earnings per share of $6 for ever. Rather than re-invest these earnings and grow, the firm plans to pay out all its earnings as a dividend. Crane’s current share price is $60.

a) What is the interest rate being used to discount future dividends paid by Crane?

b) Suppose Crane could cut its dividend pay-out rate to 75% forever, and use the retained earnings to invest in new stores. This investment would cause dividends to increase 3% for ever. Assuming the same interest rate you found in a), what effect would this policy have on Crane’s stock price?

Question 5

a) You own a portfolio with 100 shares of stock ABC, and 300 shares of stock XYZ. Today, the price of one share of stock ABC is $55 and the price of one share of stock XYZ is $15. What is the total value of your stock portfolio? What are the portfolio weights for each stock?

b) After one month, stock ABC pays a dividend of $5.88 per share. Suppose you use the dividend proceeds to buy a T-Bill. Each T-Bill pays off $100 in 60 days (i.e., the face value of the T-Bill is $100), and has a quoted yield of 12% per year. How many T-Bills can you purchase with the dividend proceeds of stock ABC?

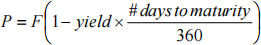

The formula linking the quoted yield y and face value F of a T-Bill to its market price P is:

c) Stocks ABC and XYZ make no other dividend payments. You keep your T-Bills and stocks until the T-Bill matures. At that time the price of one share of stock ABC is $48 and the price of one share of stock XYZ is $18. What is the total value of your portfolio (stocks+ T-Bills) at the T-Bills’ maturity? What was the holding period return of your portfolio over the entire 3-month period (one month + 60 days)? Express this return is annual terms.

Question 6

A hedge fund purchases 50 shares of stock ABC for $80 each and 200 shares of stock XYZ for $30 each. To help pay for the purchases, the fund borrowed $9,000 from a bank at 12% per year.

a) What are the weights on the hedge fund portfolio?

b) During the year stock XYZ pays a $0.10 dividend per share. At the end of one year, the hedge fund sells all its shares of stock ABC at $80 per share and all its shares of stock XYZ at $30 per share. What is the hedge fund’s holding period return?

Question 7

Myox is pharmaceutical start-up whose only project is a new flu vaccine. The company’s stock is divided in 100 millions shares. The firm currently pays no dividends. If the new vaccine is approved by the FDA, Myox is expected to pay a total of $1 billion dollars per year in dividends, forever. The company will disappear (i.e., the stock will be worth zero) if the vaccine is not approved by the FDA. The company will find out whether the vaccine is approved at the end of one year, and the first dividends (if the vaccine is approved) would be paid at the end of two years. There is a 50% probability that Myox’s vaccine will be approved. Suppose the fair interest rate that applies to Myox’s stock is 10% per year. What is the fair price of one share of Myox’s stock?

Question 8

Junkstuff’s corporate bond will mature at the end of two years. The bond promises to pay $100 dollars at the end of one year, and $1,000 at the bond’s maturity. There is a 5% probability that Junkstuff would go bankrupt at any given year. If the company goes bankrupt and does not fulfill its promises to its debtholders, it will take two years forbondholders to receive $500 for each bond they own. For simplicity, assume that if the company goes bankrupt, it will do so exactly at the time of one of the bond payments (so that the two year period is counted from the time of the missed payment). If the fair interest rate that applies to Junkstuff’s corporate bonds is 7% per year, what is the fair price of the bond?

Question 9

A share of stock will pay a $3 dividend in one year’s time, and dividends are expected to grow at 5% for another 4 years. After that, dividends are expected to grow at 2% per year forever. The fair interest rate to discount the cash flows of the stock is 10% per year.

c) What is the “fair” value of the share?

d) Suppose you buy 1,000,000 shares of the stock for its fair price today and plan to hold it for two years. What is your expected holding period return? What is the equivalent annualized return?

2023-12-13