Economics 200 Macroeconomic Theory Take-Home Final Fall 2023

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Economics 200

Macroeconomic Theory

Take-Home Final Fall 2023

Your solutions must be submitted as an attachment to an email to me at [email protected] from your vassar.edu email address sent no later than 3 PM EST on Friday, December 15, 2023. Late submissions will not be graded unless previously authorized by me. You are be required to submit a PDF file containing your written single answers to all six questions. The PDF filename must be of the form students_name_ECON_200_final_fall_2023.pdf.

This exam is designed to take about 6-8 hours to complete but you will have from 12:05 AM EST on Thursday December 7, 2023, until 3 PM EST on Friday, December 15, 2023, to work on it. You may work on it for as long as you want during that period.

Correct but unsubstantiated answers will receive no credit. Don't be shy about drawing appropriate diagrams. NB: I prefer brief, precise, complete, correct answers that include the appropriate diagram(s) to long-winded, waffling responses that mistake quantity for quality.

You may consult any written source you choose for help with the exam, provided that any such sources are properly cited. You do not need to cite class materials, the textbook, or the revision videos but failure cite any other source will be regarded as plagiarism. You may, however, communicate only with me about the exam prior to 3 PM EST on Friday, December 15, 2023, or to submitting your answers, whichever is the later. Any form of unauthorized communication with any person about the exam will result in a grade of F for the exam. As with all aspects of the course, the use of generative AI tools is not permitted in the preparation of your responses to this exam. Any such use will result in a grade of F for the exam. Submission of your answers will indicate that you understand these requirements, that you agree to be bound by them, and that you have followed them.

1. (20 points) Suppose that 5% of the US workforce spontaneously decides to retire on January 1, 2024. Analyze the short- and long-run macroeconomic effects on the US economy of the resultant fall in the workforce. Assume that the US economy is closed and that it finishes 2023 at full employment. Assume further that there is no policy response to the fall in the workforce.

2. (10 points) Consider a closed economy in which a rise in government spending is observed to have no effect on the level of aggregate demand. In such an economy, would a rise in expected inflation be reflected one-for-one in the nominal interest rate in the short run? Explain.

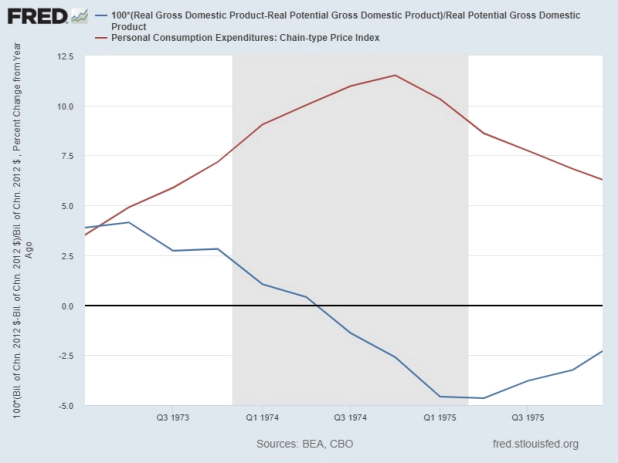

3. (20 points) The FRED chart below shows the path of the GDP gap (the blue line) and that of the inflation rate (the red line) from 1973:I to 1975:IV. Identify the type of shock that most likely caused the observed co-movement in the two lines and use a model that we've studied to show how that shock resulted in the observed co-movement.

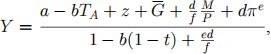

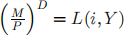

4. (10 points) Show that, if the demand for money does not depend on the nominal interest rate, then the aggregate demand function from class, viz.

is equivalent to that implied by the quantity equation, MV = PY. Explain the economics of this result.

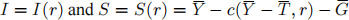

5. (20 points) Recall the model of the loanable funds market in a closed economy that we summarized in two equations—the demand for and supply of loanable funds as functions of the real interest rate i.e.  respectively. Here

respectively. Here  is net taxes which we'll assume is exogenous to simplify matters.

is net taxes which we'll assume is exogenous to simplify matters.

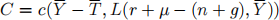

Suppose that instead of the consumption function used in class, consumption depends on the level of real balances,  , rather than the interest rate, and so the consumption function is

, rather than the interest rate, and so the consumption function is  with being an increasing function of

with being an increasing function of  for given

for given  The idea is that real balances are a form of wealth and higher wealth increases consumption at each level of disposable income.

The idea is that real balances are a form of wealth and higher wealth increases consumption at each level of disposable income.

Let the demand for real balances be given by  where i is the nominal interest rate which can be written as

where i is the nominal interest rate which can be written as  where

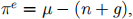

where  is the expected inflation rate. Assume, as the quantity theory implies, that long-run expected inflation is given by

is the expected inflation rate. Assume, as the quantity theory implies, that long-run expected inflation is given by  where μ is the rate of growth of the money supply, n is the rate of population growth and g is the rate of technological progress, so that is the long-run growth rate of real GDP implied by the Solow model.

where μ is the rate of growth of the money supply, n is the rate of population growth and g is the rate of technological progress, so that is the long-run growth rate of real GDP implied by the Solow model.

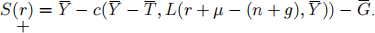

Assembling all of this n + g under the assumption that the demand for and supply of real balances are equal, we can write the consumption function as

so that the supply of loanable funds is now given by

Using this version of the model, find the long-run effects of an unexpected, permanent rise in the rate of growth of the money supply on real GDP, the real interest rate, the nominal interest rate, and the quantities of saving and investment. Does this model satisfy the classical dichotomy?

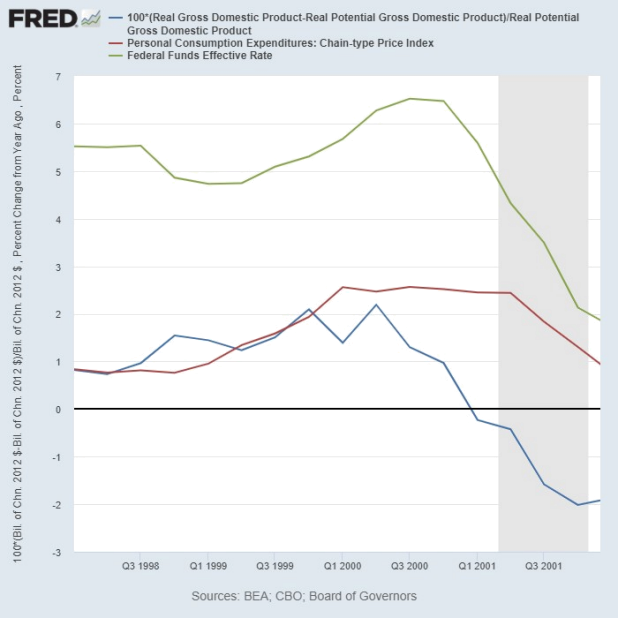

6. (20 points) The chart below shows a measure of inflation in the US (the red line, the percentage change in the PCE price index), the US GDP gap (the blue line), and the policy rate targeted by the Federal Reserve Bank, the effective federal funds rate (the green line), from 1998:I to 2001:IV. The tick marks on the horizontal axis show the start of the quarter indicated.

(a) Why did the federal funds rate begin to rise in 1999?

(b) Did that monetary policy change have the desired effect? Explain.

2023-12-11