CEN202 – Civil Engineering Project Management Coursework Brief 2023‐24

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Department of Civil Engineering

CEN202 – Civil Engineering Project Management

Coursework Brief 2023 -24

1. Background/Objectives

The objective of this coursework is to review time and cost management techniques,

quality and safety management, construction ethics and security, risk management, and life cycle costing. Various scenarios have been provided to reflect the practical situations and applications. Students are required to understand and apply the knowledge acquired during lectures of CEN202 Civil Engineering Project Management. As there is no

examination in CEN202 module, this coursework intends to assess most of the important topics studied in CEN202. The main topics covered here are:

Construction ethics and security (Assignment 1)

Risk management (Assignment 2)

Quality management (Assignment 3)

Time and cost tradeoff (crashing) (Assignment 4)

Life Cycle Costing (Assignment 5)

2. Requirements

For calculation assignments, detailed steps of the calculation process should be provided. For essay assignments, students are required to conduct short researches. The preferred

reference sources are academic journal articles and books. In case internet sources are

used as references, the source should be a reliable one. Wikipedia cannot be listed as one of your references. Check the reference format required at the department.

3. Marks

The total mark for this coursework is 100 points which will be 90% of your final mark.

4. Notes

A scanned copy of handwritten calculations is only allowed for assignment 4. The following marking scheme will be used for marking assignments 1, 2, 3.

Assignment 1 (20 pts)

With the implementation of various digital technologies, academia and practitioners are discussing the pros and cons of the digital transformation in the construction industry. Please do some relevant research and then answer the following questions. (1) What are the benefits and security risks of going through the digital transformation in our

construction industry? (2) What are the potential ethical issues resulted from the digital transformation of the industry and what are the potential solutions? (At least 4 references are required. 12pts, 1-2 pages)

Assignment 2 (20 pts)

The implementation of digital technologies and innovative approaches has transformed the traditional way of managing risks in the construction projects. Please do some

relevant research and write a report that (1) introduces one innovative

technology/approach implemented in the construction industry to effectively manage

risks at project level; (2) describes how it can be used to manages what types of risks (At least 4 references are required. Wikipedia does not count. 12pts, 1-2 pages)

Assignment 3 (20 pts)

Various innovative technologies and tools have been introduced to the construction

industry with the aim to improve the efficiency and quality of construction work. Please do some relevant research and write a report that (1) introduces one innovative

technology/tool or a combination of several technologies/tools being implemented in the industry to improve the efficiency and quality of construction work; (2) discusses the

benefits and challenges of implementing such technologies/tools. (At least 4 references are required. Wikipedia does not count. 12pts, 1-2 pages)

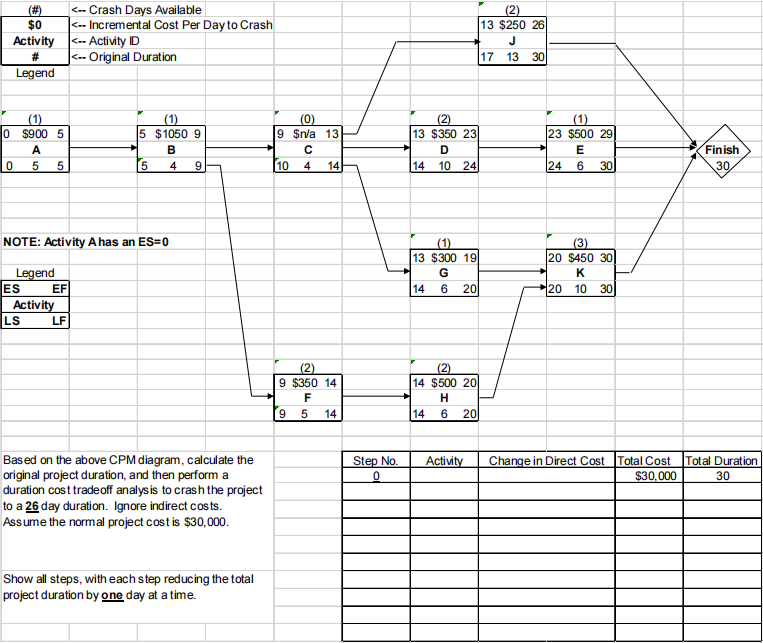

Assignment 4 (20 pts.)

Assignment 5 (20 pts)

We have learned various methods for evaluating projects ’ profitability, such as Net

Present Value (NPV), Internal Rate of Return (IRR), etc. We cannot simply say which method is better than others, because each of these methods has their own advantages. Sometimes, the combination of these methods needs to be used for optimized results. Please see the following cashflow table and answer questions (a) to (d).

Table 1. Cashflows for project A and project B

|

Year |

Project A |

Project B |

|

0 |

-$115,000 |

-$100,000 |

|

1 |

$40,500 |

$22,000 |

|

2 |

$42,000 |

$20,000 |

|

3 |

$34,500 |

$36,000 |

|

4 |

$27,000 |

$42,000 |

|

5 |

$25,000 |

$38,000 |

(a) What are the payback periods of these two projects? Which project is more financially attractive if we just consider the payback period method? [3’]

(b) Find the IRR for each project. Which project is more financially attractive based on the calculated IRR? You can use the excel function to do this. [2’]

(c) Calculate theNPV of each project at discount rates of 6%, 8%, 10%, 12%. Draw a figure showing the NPV profile of each project at these discount rates, and

discuss which project is more favorable based on the figure you developed. [10’]

(d) Use your own words to discuss at what conditions we should utilize different

financial evaluation methods – cost-benefit analysis, payback period, ROI, NPV, and IRR. [5’]

2023-12-05