ECON 178: International Trad

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ECON 178: International Trade

Project Information

Due Tuesday, November 7th at 12:30 PM

Imagine that you work for a firm considering producing a new good or service in the United

States. Your manager has tasked you with providing a summary of the international market for this good/service to determine the viability of market entry.

The project's objective is to comprehend the economic dynamics, potential benefits, and

challenges of producing your chosen product in the United States. It's not crucial whether the

product you select is genuinely viable for market entry; your project will be graded solely on the quality of your analysis.

Your written project should be no more than 5 single-spaced paged, including tables and figures. References can be included on a separate page. You have the option to work with a partner, but it is not required. All products and partnerships must be claimed on the project Google Sheet,

which is found on Canvas.

Begin by selecting the product you wish to investigate. Following that, your project should adhere to this outline:

1. Global and Historical Overview: Identify the present major global producers and consumers of the chosen product. Address these points:

. Which nations are the principal consumers, producers, exporters, and importers of this commodity? How have these dynamics shifted over time?

. Are there trade restrictions on this product that might influence market profitability?

. Highlight any recent and significant developments that may impact the global market.

2. Comparative Advantage, Strengths and Challenges: Based on your understanding of

comparative advantage, determine if it's logical for a US firm to produce this item. Describe the potential strengths and challenges of market entry.

3. Market Entry Decision: Based on your analysis, state if you believe entering this market,

either domestically or internationally, is advisable. Support your recommendation by summarizing the findings from your report.

4. References: Provide links to any information (data, articles, etc.) that you used in your project.

Other Useful Information

. Products, in the context of international trade, are categorized using the “Harmonized System” (HS) codes. Identify and report the HS code of your selected product in your project.

. Ensure you incorporate graphs or figures depicting the market. To earn full credit, you must visualize and describe data. You can build your graphs from data you find or

repurpose figures found online. In either case, clearly cite the data or figure's origin.

Potentially helpful websites

o OEC World: Provides extensive trade data, highlighting major global producers and consumers of goods.

o The U.S. International Trade Commission (USITC): Offers data on imports, exports, tariffs, and more.

o US Department of Commerce Website. Gives data on US-specific imports and exports, categorized by trading partners. Data is reported from 2009.

o Census Bureau: Provides aggregated trade data, including monthly and annual trade statistics.

o World Trade Organization Tariff Data: Search by country and byproduct. The data it produces is complex, but it could be helpful in finding a product that is

affected by trade restrictions in countries other than the United States.

o World Trade Organization: Statistical data about trade flows and trade policies for its member nations. The product codes are not as precise as the US-based

websites.

o IBISWorld: Offers industry research reports, which include key statistics and analysis on market characteristics. Many of the indices are not available free, but

some of the free ones may be interesting.

o Trade Map: Offers trade statistics for international business development.

o You're also welcome to explore and utilize other data sources and websites.

. Artificial Intelligence. I encourage incorporating AI platforms to brainstorm ideas and assist in writing your project. Conclude your project by detailing how AI facilitated your work.

. Grading Guidance

o For each section, ensure that you've done the following:

Demonstrated a thorough understanding of the topic.

. Presented relevant information and facts.

. Included figures that are relevant and easy to read.

. Drawn appropriate conclusions based on the presented information.

. Properly cited necessary sources/references with consistent formatting.

. Maintained clear writing, free of typos and grammatical mistakes.

. Followed formatting and length requirements.

o If you basically copy the example provided below, using a different product and executing it well, it will earn 85% on the project You should try to approach the

project from your own personal perspective.

o I will be spot-checking data references. Fabricating data will lead to significant penalties.

o You must claim your product and any partnerships on the Google sheet by the end of week 2. This is worth 5% of the project.

International Trade Project Example

Econ 178 – Fall 2023

For my project, I chose to explore the possibility of producing washing machines in the United States. I chose this because I know there was a large tariff placed on washing machines in 2018 and I am interested in learning more about how that tariff affected the market. Note: you can

approach the project in whichever way you find most interesting.

The four-digit HS code for “Household- or laundry-type washing machines” is 8540, with four subcategories based on size and components. This project will report at the four-digit level,

averaging the subcategories when necessary.

Global and Historical Overview

In 2021, global sales of washing machines were valued at approximately $65.7 billion (Statista, 2023). In that year, China was the world’s largest producer, consumer and exporter of washing machines (Modor Intelligence, 2023). The value of washing machine exports and imports were equal to $16.7 billion, so traded goods make up approximately 25% of the total production of washing machines.

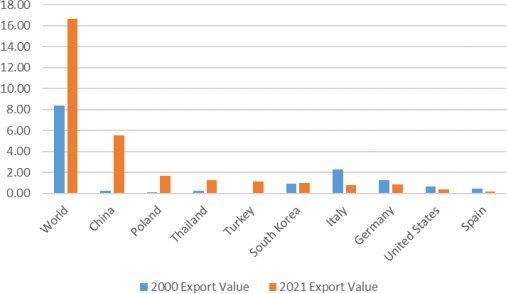

Figure 1 provides some historical context for the major importers and exporters of washing

machines. In the year 2000, Italy was the world’s largest washing machine exporter, exporting 27.1% of all washing machines on the world market. China only exported 2.92% of exports in 2000. China overtook Italy in export value in 2008. By 2021, Italy's exports had decreased to only 4.65% of washing machines.1

The United States has remained the largest importer of washing machines since 2000, importing products equaling $2 billion that represented approximately 12 percent of all of the washing

machines that were exported to the world market in 2021. This is more than twice that of the

other top importers, which include many developed countries throughout the world. Although China is the largest purchaser of washing machines, it only imports $174 million of washing

machines. This implies that they produce the majority of washing machines that they consume.

Although it is the largest importer of washing machines, factories in the United States still

produces a substantial number of machines. The United States imports approximately $2 billion worth of washing machines, but the total market for machines is approximately $5.1 billion

(Grand View Research, 2023). This implies that domestic production of washing machines was equal to $3.1 billion in 2021, comprising more than half of the market.

Domestic firms have successfully lobbied for the United States government to impose tariffs to protect their industry from international competition for the last decade. The first tariffs were

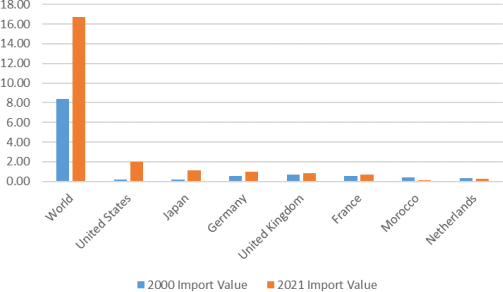

imposed in 2013 as anti-dumping duties, applied only to South Korea and Mexico. Figure 2

illustrates the effect of this tariff, showing the imports from South Korea and Mexico declined after the tariff was imposed.

Figure 1

Top Exporters and Importers of Washing Machines (Billions US $)

2000 and 2021

Panel A: Top Exporters

Panel B: Top Importers

Data Source: OEC, 2023. 2000 Values are adjusted to 2021 price levels.

Figure 2:

USD Value (Millions) of Washing Machine Imports to the United States

by Country

Data Source: US Department of Commerce

Figure 2 also shows that as the tariffs were applied to imports from South Korea and Mexico,

imports from China were growing dramatically. Domestic producers again lobbied the United

States government and were successful at applying anti-dumping duties to Chinese imports in

2017 (Federal Register, 2017). A large reduction in Chinese imports followed. South Korea

contested the 2013 anti-dumping tariffs with the WTO and their dispute was upheld in February of 2018 (Reuters, 2018).

More recently, the United States imposed a large safeguard tariff-rate quota on washing

machines in January 2018. The United States Trade Representative recommended a tariff after a joint investigation by the US International Trade Commission and the Trade Policy Committee in response to cases filed by domestic manufacturers. That report concluded that, “increased

foreign imports of washers and solar cells and modules are a substantial cause of serious injury to domestic manufacturers” (United States Trade Representative, 2018).

The tariff-rate quota was to be phased-in over three years. The tariff rate ranged between 20 and 50 percent, and was applied differentially to finished washing machines and parts. The tariff was reduced in each year in February between 2019 and 2022, before it expired in 2023 (Peterson

Institute, 2023). Not shown in Figure 2 is that total imports decrease 33% in 2018 then climbed steadily until 2021. Imports decreased again in 2022, likely due to macroeconomic factors.

These trade restrictions have not only reduced imports, but also increased the price of washing

machines. Recent research has estimated that washing machine tariffs have increased the price of

washing machines in the United States by 12%. Perhaps even more interesting, the price of

dryers has also increased by the same, even though these appliances were not subject to any

additional tariffs (Flaaen, 2020). This suggests that producing washing machines primarily for domestic purchase maybe the most profitable way to enter this market.

Comparative Advantage, Strengths and Challenges

The United States has a rich history of manufacturing, with advanced infrastructure and capital- intensive industries. The raw materials required for washing machines, such as sheet steel,

stainless steel, and cast aluminum (MadeHow, 2023) were once abundantly produced in the

United States, but the domestic aluminum and steel industries have both declined in recent years, due to a rise in imports (Statista, 2023a; Statista, 2023b). However, the U.S. has fostered a

growing plastics industry, which can efficiently supply the plastic components needed (Statista, 2023c). Therefore, in terms of raw material availability, the U.S. is well poised to manufacture washing machines.

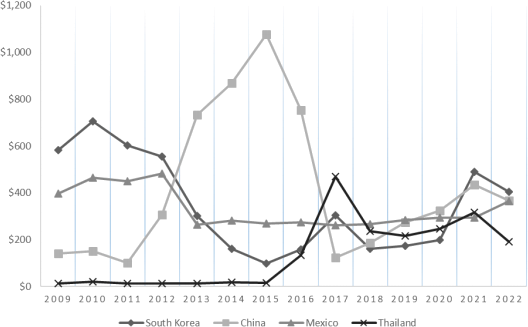

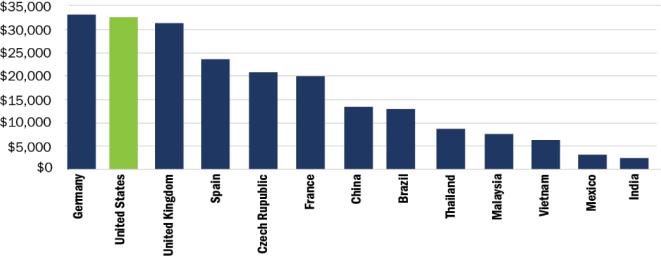

Figure 3:

Average Salaries of Production Worker & Machine Operators by Country

Figure Source: Reshoring Institute (2022)

Stated Data Source: Indeed.com; Glassdoor.com; Salaryexplorer.com; Salary.com; Payscale.com

Given that several components of the washing machine manufacturing process are manually assembled, labor costs are an important factor to consider. Figure 3 provides some recent

estimates of production labor costs across 12 countries, including the United States and China. It shows that labor costs in the United States are over twice those found in China and Thailand,

both of which are major exporters of washing machines. Despite recent growth in Chinese wages (Vox, 2017), higher wages in the United States make it challenging to compete against lower

wages and the existing economies of scale in a country like China.

Market Entry Decision

To conclude, entering the global washing machine market would mean facing strong competition from firms in countries like China and South Korea. These firms already enjoy a large market

share and they have the advantage in labor costs and economies of scale. The most promising

way to enter this market as a new U.S.-based firm is to focus on creating efficient automation.

However, it is not guaranteed that investments in this kind of technological advancements will be successful or profitable.

Although the United States has instituted several trade restrictions to support the domestic

production of washing machines, the strength of those restrictions is decreasing as restrictions

are successfully disputed and expire. Success in this market as a new entrant would likely require

additional protection from international competition. Even with that protection, market

concentration of the domestic industry is moderate to high (Flaaen, 2020), so it maybe difficult to find new customers when other brands are already established.

In conclusion, I would not suggest entering the washing machine market as a U.S.-based firm at this time.

References

Federal Register. (2017). Large Residential Washers From the People's Republic of China:

Amended Final Affirmative Antidumping Duty Determination and Antidumping Duty Order.

https://www.federalregister.gov/documents/2017/02/06/2017-02469/large-residential-washers- from-the-peoples-republic-of-china-amended-final-affirmative-antidumping

Flaaen, A., Hortaçsu, A., & Tintelnot, F. (2020). The production relocation and price effects of US trade policy: the case of washing machines. *American Economic Review, 110*(7), 2103- 2127.

Grand View Research. (2023). U.S. Residential Washing Machine Market Size, Share & Trends Report.https://www.grandviewresearch.com/industry-analysis/us-residential-washing-machine- market-report

MadeHow. (2023). How Products are Made: Washing Machines.

http://www.madehow.com/Volume-1/Washing-Machine.html

Modor Intelligence. (2023). China Washing Machine Market Size & Share Analysis - Growth

Trends & Forecasts (2023 - 2028).https://www.mordorintelligence.com/industry-reports/china- washing-machine-market

OEC (Observatory of Economic Complexity). (2023). Household Washing Machines.

https://oec.world/en/profile/hs/household-washing-machines#trade

Reshoring Institute. (2023). Global Labor Rate Comparisons.

https://reshoringinstitute.org/reshoring-white-paper-global-labor-rate-comparisons/

Reuters. (2012). U.S. sets duties on washers from Mexico, South Korea.

https://www.reuters.com/article/us-usa-trade-washers/u-s-sets-duties-on-washers-from-mexico- south-korea-idUSBRE86T0YY20120730

Reuters. (2014). INSIGHT-A washing machine factory tests Italy's industrial future.

https://www.reuters.com/article/europe-deflation-italy/insight-a-washing-machine-factory-tests- italys-industrial-future-idUSL3N0M42TF20140310

Reuters. (2018). WTO awards South Korea $85 million against U.S. over washing machine tariffs.https://www.reuters.com/article/us-usa-trade-southkorea-wto-idUSKCN1PX1PY Statista. (2023a). Steel production figures in the U.S. from 2006 to 2022.

https://www.statista.com/statistics/209343/steel-production-in-the-us/

Statista. (2023b). Primary aluminum production in the United States from 2010 to 2022.

https://www.statista.com/statistics/312839/primary-aluminum-production-in-the-united-states/

Statista. (2023c). U.S. plastics industry - statistics & facts.

https://www.statista.com/topics/7460/plastics-industry-in-the-us/

Vox. (2017). Why "Made in China" could soon be a thing of the past.

https://www.vox.com/world/2017/2/27/14750198/china-wages-rising

AI Statement

I used Bing AI to find some sources. I used ChatGPT to learn more about some of the concepts that I didn’t know as much about. I also provided an outline to ChatGPT of the points that I

wanted to make in the Comparative Advantage Section and asked it to fill in the gaps. I ended up using the general structure, but edited it and added citations where necessary. Finally, I asked

ChatGPT to proofread it for typos and grammatical errors.

2023-11-05