Econ 311: Advanced Macroeconomics

Econ 311: Advanced Macroeconomics

Problem Set 2

Due: 13 October 2023

• Submit your assignment as a single file via CANVAS by 13 October 5pm (Week 11).

• This assignment consists of 3 questions and is worth 15% of the final grade.

• The weight of the question and the word limit appear next to each question.

• Use Excel (or its analogues) to make plots and computations.

• All statements and data from external sources (other than lecture notes) needs to be properly referenced (e.g. using Harvard style).

1 Inflation targeting (weight 5%, word limit: 400 words)

Select two out of the following central banks: Bank of England, Reserve Bank of New Zealand, Bank of Canada, and the Swedish Riksbank. Each of these central banks has adopted explicit ‘inflation targeting’. For each of your chosen banks, answer the following questions:

1. What is their target level of inflation and how do they justify choosing that level?

2. Did they hit the zero lower bound (ZLB) on nominal interest rates during or after the global financial crisis? Give examples of the countries that had their nominal interest rates hit the ZLB. Present some evidence of a public debate about the dangers of ZLB and the policy options that might lead the economy away from ZLB (from news, blogs, CB’s publications etc.).

2 Measuring economic activity (weight 5%)

[Excel Problem] Download quarterly, seasonal adjusted data on US real GDP, personal consumption expenditures, and gross private domestic investment for the period 1960Q1- 2023Q2. You can find these data in “Section 1 Domestic Product and Income”, in the BEA NIPA Table 1.1.6, “Real Gross Domestic Product, Chained Dollars” (link to BEA).

1. Take the natural logarithm of each series (=ln(series)) and plot each against time. Which series appears to move around the most? Which series appears to move the least?

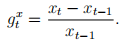

2. The growth rate of a random variable x, between dates t − 1 and t is defined as

(1)

(1)

Calculate the growth rate of each of the three series (using the raw series, not the logged series) and write down the average growth rate of each series over the entire sample period. Are the average growth rates of each series approximately the same?

3. As discussed in Week 7, the first difference of the log is approximately equal to the growth rate:

gt x ≈ ln(xt) − ln(xt−1). (2)

Compute the approximate growth rate of each series this way. Comment on the quality of the approximation.

4. The standard deviation of a series of random variables is a measure of how much the variable jumps around about its mean (=stdev(series)). Take the time series standard deviations of the growth rates of the three series mentioned above and rank them in terms of magnitude (provide your calculated standard deviation when you rank them).

recession according to your measure? [Hint: to classify a quarter as “in recession”, use =IF(AND()) to check whether the current and subsequent GDP growth rate is negative, classifying the quarter as a recession only if both these conditions are true.]

Please submit your plots along with your answers. You do not need to submit your Excel spreadsheet as a pdf supplement to your answers (although you may if you wish).

3 Patriotic consumption (weight 5%, word limit: 300 words)

Imagine that the Prime Minister has just tweeted:

We need to help our economy. I’m going to ask that each of you go out and buy stuff. If you all do that, that’ll get the economy going.

Suppose the typical household reacts to the announcement as follows:

I wasn’t planning to do this, but the Prime Minister seems like such a wise leader that I’m going to do my patriotic duty and buy myself a lawnmower. Using the New Keynesian model from Topic 2 in our course, explain the short-run macroeconomic effect of patriotic consumption (using mathematical and/or graphical aids along with explanations). Why might one argue that this is a desirable outcome? What does the New Keynesian model exclude that might lead one to argue that this is an undesirable outcome?

2023-10-14