FINA865 FINANCIAL RISK MANAGEMENT FINAL EXAMINATION SEMESTER V2 2022

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

FINANCIAL RISK MANAGEMENT

FINA865

FINAL EXAMINATION

SEMESTER V2 2022

Date: Saturday 23 July 2022

SECTION 1:

MULTIPLE CHOICE QUESTIONS (TOTAL: 10 MARKS)

For each of the following questions, there is only ONE correct answer. Choose the correct answer and write down the corresponding letter in your answer sheet.

Each question is worth 1 mark.

1. You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:

|

Wildwood Corp Options: |

|||

|

Expiration |

Strike |

Call |

Put |

|

June |

45.00 |

8.50 |

2.00 |

|

June |

50.00 |

4.50 |

3.00 |

|

June |

55.00 |

2.00 |

7.50 |

|

Stock price: $50.00 |

|||

To establish a bull money spread with calls, you would ________.

(a) buy the 55 call and sell the 45 call

(b) buy the 45 call and buy the 55 call

(c) buy the 45 call and sell the 55 call

(d) sell the 45 call and sell the 55 call

(e) buy the 40 call and buy the 50 call

2. Suppose the price of a share of Google stock is $500. An April call option on Google stock has a premium of $5 and an exercise price of $500. Ignoring commissions, the holder of the call option will earn a profit if the price of the share

(a) increases to $504.

(b) decreases to $494.

(c) increases to $506.

(d) decreases to $496.

(e) none of the above options are correct.

3. You own $75,000 worth of stock, and you are worried the price may fall by year-end in 6 months. You are considering using either puts or calls to hedge this position. Given this, which of the following statements is (are) correct?

I. One way to hedge your position would be to buy puts.

II. One way to hedge your position would be to write calls.

III. If major stock price declines are likely, hedging with puts is probably better than hedging with short calls.

(a) I only

(b) II only

(c) III only

(d) I, II, and III

(e) I and III only

4. Suppose you use put-call parity to compute a European call price from the European put price, the stock price, and the risk-free rate. You find the market price of the call to be less than the price given by put-call parity. Ignoring transaction costs, what trades should you do?

(a) buy the call and the risk-free bonds and sell the put and the stock

(b) buy the stock and the risk-free bonds and sell the put and the call

(c) buy the put and the stock and sell the risk-free bonds and the call

(d) buy the put and the call and sell the risk-free bonds and the stock

(e) none of the above

5. You are convinced that a stock's price will move by at least 15% over the next 3 months. You are not sure which way the price will move, but you believe that the results of a patent hearing are going to have a major effect on the stock price. Suppose that you are somewhat more bullish than bearish about investment in this stock. Which one of the following options strategies best fits this scenario?

(a) Buy a strip that consists of a long position on one at-the-money call and two at-the-money puts with the same expiration.

(b) Buy a strap that consists of a long position on one at-the-money put and two at-the- money calls with the same expiration.

(c) Buy a straddle that consists of a long position on one at-the-money put and one at-the-money calls with the same expiration.

(d) Write a straddle that consists of a short position on one at-the-money put and one at-the-money calls with the same expiration.

6. Consider a swap to pay currency A floating and receive currency B floating. What type of swap would be combined with this swap to produce a swap to produce a plain vanilla swap in currency B that one party pays currency B fixed and the counterparty receives currency B floating?

(a) A swap to pay currency B floating and receive currency A fixed.

(b) A swap to pay currency B fixed and receive currency A floating.

(c) A swap to pay currency B fixed and receive currency A fixed.

(d) A swap to pay currency B floating and receive currency A floating.

(e) None of the above options.

7. Portfolio A consists of 600 shares of stock and 300 calls on that stock. Portfolio B consists of 685 shares of stock. The call delta is 0.3. Which portfolio has a higher dollar exposure to a change in stock price?

(a) Portfolio B.

(b) Portfolio A.

(c) The two portfolios have the same exposure.

(d) Portfolio A if the stock price increases, and portfolio B if it decreases

(e) Portfolio B if the stock price increases, and portfolio A if it decreases

8. The Black-Scholes formula assumes that __________

I. the risk-free interest rate is constant over the life of the option.

II. the stock price volatility is constant over the life of the option.

III. the expected rate of return on the stock is constant over the life of the option.

IV. there will be no sudden extreme jumps in stock prices.

(a) I and II

(b) I and III

(c) II and III

(d) I, and II, and IV

(e) I, II, III, and IV

9. A trader who has a __________ position in gold futures wants the price of gold to __________ in the future.

(a) long; decrease

(b) short; decrease

(c) short; stay the same

(d) short; increase

(e) long; stay the same

10. If you determine that the S&P 500 Index futures is overpriced relative to the spot S&P 500 Index, you could make an arbitrage profit by __________

(a) buying all the stocks in the S&P 500 and selling put options on the S&P 500 Index.

(b) selling short all the stocks in the S&P 500 and buying S&P Index futures.

(c) selling all the stocks in the S&P 500 and buying call options on the S&P 500 Index.

(d) selling S&P 500 Index futures and buying all the stocks in the S&P 500.

(e) none of the above options are correct.

SECTION 2:

SHORT ANSWER QUESTIONS (TOTAL: 40 MARKS)

Question 1 (Principles of Option Pricing) (7 marks)

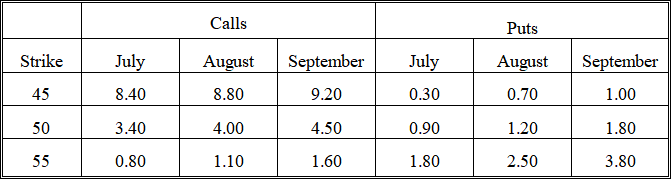

The following quotes were observed for options on a given stock on July 1 of a given year. These are European calls and puts except where indicated.

The stock price was 53.25. The risk-free rates were 3.30% (July), 3.50% (August) and 3.62% (September). The times to expiration were 0.0384 (July), 0.1342 (August), and 0.211 (September). Assume no dividends unless indicated.

(a) What is the intrinsic value of the August 55 put? (1 mark)

(b) What is the intrinsic value of the September 55 call? (1 mark)

(c) What is the time value of the July 45 put? (1 mark)

(d) What is the time value of the July 45 call? (1 mark)

(e) What is the European lower bound of the August 50 call? (1 mark)

(f) From American put-call parity, what is the minimum value that the sum of the stock price and September 55 put price can be? (1 mark)

(g) Suppose you knew that the July 50 options were correctly priced but suspected that the stock was mispriced. Using put-call parity, what would you expect the stock price to be? (1 mark)

Question 2 (Binomial Model) (5 marks)

Consider a stock currently priced at $20. In the next period, the stock can either increase by 30% or decrease by 10%. Assume a European call option with an exercise price of $20 and a risk-free rate of 5%.

(a) What is the theoretical value of the call for the stock according to one-period binomial model? (2.5 marks)

(b) Suppose the call option is currently trading at $3. If the option is mispriced, what amount of riskless return can be earned using a riskless hedge? (2.5 marks)

Question 3 (Basic Option Strategies) (4 marks)

Consider a stock currently priced at $10 with a standard deviation of 20%. The risk-free rate is 6%. There are put and call options available at exercise prices of $10 and a time to expiration of six months. The calls are priced at $1.89 and the puts cost $1.15. There are no dividends on the stock and the options are European. Assume that all transactions consist of 100 shares or one contract (100 options).

(a) What is your profit if you buy a call, hold it to expiration and the stock price at expiration is $15? (1 mark)

(b) What is the breakeven stock price at expiration on the transaction in part (a)? (1 mark)

(c) Suppose the investor constructed a covered call. At expiration the stock price is $8. What is the investor's profit? (1 mark)

(d) What is the breakeven stock price at expiration for the transaction described in part (c)? (1 mark)

Question 4 (Advance Option Strategies) (6 marks)

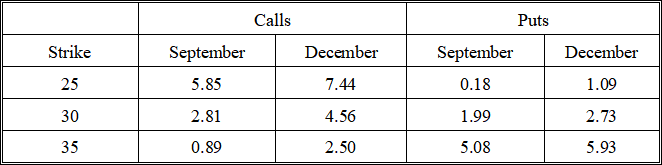

The following prices are available for call and put options on a stock that is currently priced at $30. The risk-free rate is 5% and the stock volatility is 20%. The September options have 90 days remaining and the December options have 180 days remaining. The Black-Scholes model was used to obtain the option prices.

Assume that each transaction consists of one contract (for 100 shares) unless otherwise indicated.

(a) Construct a bull money spread using the September 25/30 calls and determine how much this spread will cost. Under what market condition does this spread strategy work well? (2 marks)

(b) Suppose an investor expects the stock price to remain at about $30 and decides to execute a butterfly spread using the December calls. What will be the profit of this spread strategy if the stock price at expiration is $32.50? (2 marks)

(c) Suppose you wish to construct a long straddle constructed using the September 30 options. What is the profit of this strategy if the stock price at expiration is $40.75? What is the stock price range within which this strategy is profitable? (2 marks)

Question 5 (Put-Call Parity of Options on Futures) (5 marks)

The put – call parity rule can be expressed as C – P = [f0(T) – X](1 +r)-T. Consider the following data: f0(T) = 103, X=100, r=0.1, T= 0.25, C= 3.25, and P=2.25. A few calculations will show that the prices do not conform to this rule. As such, you need to suggest an arbitrage strategy and show how it can be used to capture a risk-free profit. Assume that there are no transaction costs. Be sure your answer shows the payoffs at expiration and proves that these payoffs are riskless. (5 marks)

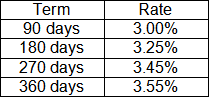

Question 6 (Pricing and Valuation of Interest Rate Swaps) (6 marks)

A corporation enters a $50 million notional amount interest rate swap. The swap calls for the corporation to pay a fixed rate and receive a floating rate of LIBOR. The payments will be made every 90 days for one year and will be based on the adjustment factor 90/360. The term structure of LIBOR when the swap is initiated is as follows:

(a) Determine the fixed rate on the swap. (2 marks)

(b) Calculate the first net payment on the swap. (2 marks)

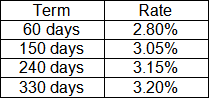

(c) Assume that it is now 30 days into the life of the swap. The new term structure of LIBOR is as follows:

Calculate the value of swap. (2 marks)

Question 7 (Value at Risk) (3 marks)

Consider a portfolio consisting of $15 million invested in the S&P 500 and $5 million invested in U.S. Treasury bonds. The S&P500 has an expected return of 10% and a standard deviation of 20%. The Treasury bonds have an expected return of 3% and a standard deviation of 10%. The correlation between the S&P 500 and the bonds is 0.1. All figures are stated on an annual basis.

(a) Use the analytical method to determine the portfolio VAR for one year at a probability of 0.05. (1 mark)

(b) Using the information that you obtained in part (a), find the portfolio VAR for one day at a probability of 0.05. (1 mark)

(c) Interpret the two VAR values obtained in parts (a) and (b) respectively so that they would be easily understood by a nontechnical corporate executive. (1 mark)

Question 8 (Futures) (4 marks)

Suppose your client says, “I am invested in Australian stocks but want to eliminate my exposure to this market for a period. Can I accomplish this without the cost and inconvenience of selling out and buying back again if my expectations change?”.

(a) Briefly describe a strategy to hedge both the local market risk and the currency risk of investing in Australian stocks. (2 marks)

(b) Briefly explain why the hedge strategy you describe in part (a) may not be fully effective (hint: name some practical difficulties with the hedge strategy). (2 marks)

2023-08-26