MGMT20005 Business Decision Analysis Tutorial 3

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

MGMT20005 Business Decision Analysis

Tutorial 3: Value of Information

Case Problem

A firm is considering launching a new product. The firm can choose not to launch the new product and keep selling their existing product. In this case, the firm will have a risk free income of 60. Suppose the firm decides to launch the product. Then it faces two uncertainties concerning the market share and the R&D success of the product.

• Market share: Based on the current information the directors of the firm believe that there is equal chance to have a high share and a low share. That is, P(high market share) = P(low market share) = 0.5.

• Product success: The current belief is that the success rate is just a half. That is, P(high success) = P(low success) = 0.5.

• The above two chance events are assumed to be independent of each other.

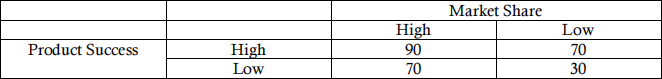

The expected incomes under different scenarios are given in the following table:

To reduce the risk of launching the new product, the firm may employ a market analyst to determine the market share and/or a scientist to help determine the success rate of the product.

The analyst’s success rate (when predicting market share) is known to be: P(“says high”|high) = 0.8 and P(“says low”|low) = 0.7.

The scientist’s success rate (when predicting product success) is known to be: P(“says high”|high) = 0.8 and P(“says low”|low) = 0.9.

a. What should the firm do (before obtaining more information from the analyst or scientist)?

b. What is the value of perfect information for each event separately? That is, obtaining perfect information for:

i. Market share

ii. Product success

c. What is the maximal fee the firm would be willing to pay the two experts separately? That is, obtaining sample information for:

i. Market Analyst

ii. Scientist

2023-08-22

Value of Information