Finance 362 2023SC Workshop 1

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Finance 362

2023SC

Workshop 1

Topic 2: Introduction to Forwards and Futures

1. Types of derivatives contracts

|

Forwards |

Futures |

Options |

|

ü OTC |

|

|

|

ü Customised product |

|

|

|

ü P/L settled at maturity |

|

|

|

ü No initial payment |

|

|

|

ü Physical delivery |

|

|

|

ü A/L |

|

|

|

ü Some credit risk |

|

|

|

ü High negotiation costs |

|

|

|

ü Low liquidity |

|

|

|

ü Neutralise your risk by fixing the price you buy/sell |

|

|

2. Margining system of futures contracts

. Minimum price movement that will trigger a margin call:

e.g. An investor enters into five short futures contracts on frozen orange juice. Each futures contract is for the delivery of 15,000 pounds. The current futures price is 160 cents per pound, the initial margin is $6,000 per contract, and the maintenance margin is $3,000 per contract. What price change would lead to a margin call? (NB: Always remember to indicate the direction of the movement, i.e. upward or downward?)

3. Forward Rate Agreement (FRA) - to protect themselves against a future interest rate movement for a specified period at a specified contract rate. (traded on OTC, cash settlement at maturity, no delivery of principal required)

![]() BORROWER needs to FRA to hedge!

BORROWER needs to FRA to hedge!

e.g. Australasian FRA

- Borrower enter into a FRA (buyer)

- At time 0, agree to borrow the 90 days BB @ rc at time m (i.e. in 1 month time)

- At time m, turns out that the actual 90 days BB interest rate is rm

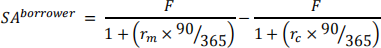

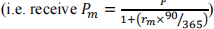

- At time m, SA to be paid by the borrower at time m is therefore:

- At time m, borrow @ rm in the physical market

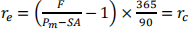

- effective interest rate is

RQ Topic 2 MCQ 5 to 7

A company plans to issue 90 day bank bills with a face value of $1 million in two months’ time. The treasurer enters into a 2X5FRA at a contract rate of 5.5% to hedge the interest rate risk. The bank bills are issued in two months’ time on the day the FRA is settled when the 90 day bank bill rate is 6.5%.

Q5. What is the settlement amount on a 2X5FRA on a face value of $1 million bought at a contract rate of 5.5% and settled at a market rate of 6.5%?

Q6. What is the effective interest payment on the borrowing (i.e. the discount on the bills issued plus/minus the settlement amount of the FRA)?

Q7. What is the effective interest rate on the borrowing?

Past Term Test Q

Consider a company that plans to borrow in 180 days by issuing 180-day bank bills. The company is worried that the 6-month interest rate will rise when it issues the bank bills so it entered into a long position in a 4.5% 6×12FRA (ie. a 6-month loan, 6 month from now) with a face value of $2.5 million. Assume all rates are measured with a compounding frequency reflecting the length of the period they apply to. Also assume there are 365 days in a year.

(a) At contract expiration, the 180-day bank bill rate has decreased to 3.5% p.a., which is below the contract rate of 4.5% p.a.. Calculate the value of the FRA at its maturity. (Please record your answer in 4 d.p.)

(b) Suppose 90 days after the initiation (assume t = 90 now), the “new” FRA price on the original FRA decreased to 4% p.a.. The 90-day bank bill rate is 3.5% p.a.. Value this FRA today (i.e. t=90).

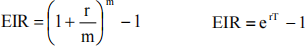

4. Periodic v Continuous compounding

. The conversion between the simple rates & c.c. rates

e.g. The current interest rate offered by bank is 8% p.a. compounded annually, what is the equivalent quarterly compounded interest rate? And what’s the equivalent continuously compounded interest rate?

5. FRA rates are set to the “implied forward rate”, which is implied from current spot or zero coupon rates.

e.g. The 6-month, 12-month, 18-month, and 24-month zero rates are 3.9%, 4.5%, 4.7%, and 4.9% with continuous compounding. What is the c.c. forward rate for the six-month period beginning in 18 months?

Topic 3: Pricing of forwards & futures

1. Pricing of forwards & futures contract (F)

a. Investment Assets

Cost of carry model

i) with no income

ii) with known CFs

iii) with known yield

b. Consumption Assets

- Cannot use pure cost of carry model as convenience yield cannot be measured (it can only be observed/implied)

- Holder reluctant to short sell or lend the asset to the party who needs to short sell to arbitrage, which impede arbitrage opportunity when F < (S+U)erT or F < Se(r+u)T

- F <= (S+U)erT or F <= Se(r+u)T observed

- We thus include a measure of convenience yield (y) to make both sides equal

i.e. FeyT = (S+U)erT or F = Se(r+u-y)T

Q1

If the spot price of a metal is $7,250 per tonne, the risk free rate is 5% p.a. (continuously compounded), storage costs are $20 per tonne per month, payable at the beginning of the months. What is the theoretical price of a forward contract (written on one tonne of metal) with two months to expiration?

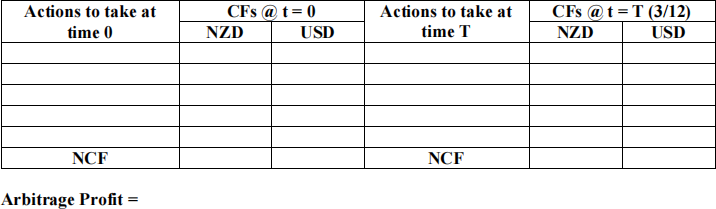

If the current forwards contact with two months to expiration is $7,400, how can you arbitrage by taking an initial position (either long or short) of one forward contract? Your arbitrage strategy should be structured so that the NCF at initiation (time 0) is zero.

Q2

Three-month interest rates (continuously compounded) are 1% p.a. in the US and 4% p.a. in New Zealand and the current spot rate of the New Zealand dollar is USD0.8000. What is the theoretical three-month forward rate on the NZD?

If the current three-month forward rate of NZD is 0.7900USD, carefully explain how you could exploit any arbitrage opportunity by borrowing either NZD 1 million or USD 1 million today. Calculate the exact arbitrage profit in NZD in three-month time.

2. Distinction between forwards price (F) and value of forwards (f)

a. Price of a forward contract (F) is the price at which you agree to buy or sell the underlying asset at a future time.

b. Value of a forward contract (f) is the PV of the difference between the current forward price (F) and the contracted forward price agreed to (K).

. f =

. At initial, f =

. value of long position =

. value of short position =

RQ PQ5

Contact Energy is expected to pay a dividend of 15 cents per share in two months and 20 cents per share in eight months. The current stock price is $5.10 and the risk-free rate of interest is 8% p.a. (continuously compounded) for all maturities. An investor who holds the stock has just taken a short position in a twelve- month forward contract on the stock.

(a) What are the theoretical forward price and initial value of the forward contract?

(b) Six months later the price of the stock is $4.40 and the risk-free rate of interest is 9.00% p.a. (continuously compounded). What are the forward price and value of the short position in the forward contract?

2023-08-19