ST301 Actuarial Mathematics 2020

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

January 2020 exam

ST301

ActuariaI Mathematics (Life)

1. ThieIe ODE for singIe Iife modeIs. consider a standard n-year pure endowment with sum insured S and premium π payable continuously during the insurance period. The force of mortality of the insured and the interest rate are denoted by μx+t and r respectively. Assume that there is the following additional beneit: if the insured dies before time n, a fraction f E (0, 1) of the reserve vt is being paid out (at the time of death) to the dependants of the insured.

(a) Set up Thiele,s differential equation for vt, and write down the boundary condition. [6 marks]

(b) By examining the previous differential equation, show that the reserves are the same as for a standard n-year pure endowment, sum insuredS, premium π, no other beneit, but where the insured has modiied mortality intensity equal to (1 -f )μx+t. [4 marks]

[Total=10 marks]

2. Describe the main objective of the underwriting procedure in the context of life insurance. Also, discuss why insurers generally require evidence of health from a person applying for life insurance but not for an annuity. [5 marks]

3. seIect survivaI modeI, Assurances and Annuities.

(a) A select survival model has a select period of three years. calculate 3p53, given that

q [50] = 0.01601, 2p [50] = 0.96411, 2|q [50] = 0.02410, 2|3q [50]+1 = 0.09272.

[8 marks]

(b) A policyholder is subject to extra risk that is modelled by a constant addition to the force of mortality, so that, if the extra risk functions are denoted by \, μ![]() = μx + Φ . Show that at rate of interest i,

= μx + Φ . Show that at rate of interest i,

A(-)![]() = A(-)

= A(-)![]() + Φu(-)

+ Φu(-)![]() ,

,

where j is arate of interest that you should specify [5 marks]

(Notice that in (b) you are not asked to use any of the previous values.)

(c) In the R session below m represents the force of mortality and the force of interest is 0.03.

library(deSolve)

m=function(t)

{

0.0008+0.00009323541*exp(0.09898345*t)

}

p=function(x,t)

{

a1=exp(0.09898345*(x+t))

a2=exp(0.09898345*x)

b1=0.0008*t+0.00009323541*(a1-a2)/0.09898345

return(exp(-b1))

}

vv1 = function(t, v, parms) {

list(c(0.03*v[1] + 2*m(40 + t)*v[1] - 2*m(40 + t)*v[2] - 1,

0.03*v[2] + m(40 + t)*v[2] - 1))

}

t1=seq(from=20, to=0, by=-5)

out1=lsode(y = c(0, 0), times = t1, vv1, parms = NULL)

out1

## time 1 2

## 1 20 0.000000 0.000000

## 2 15 4.618640 4.357760

## 3 10 8.544683 7.893818

## 4 5 11.914305 10.953597

## 5 0 14.827757 13.667219

p(40,10)

## [1] 0.9125719

use the above results to calculate the following quantities (feel free to truncate everything to three or four decimal places).

![]() i. a(-)

i. a(-) ![]() 50:50:10

50:50:10 ![]() , [2 marks]

, [2 marks]

![]() ii. a(-)40:40:10

ii. a(-)40:40:10 ![]() . [5 marks]

. [5 marks]

[Total=20 marks]

4. Expenses and premiums. consider a 20-year annual endowment insurance with sum insured 110000 issued to a select life aged 35 whose force of mortality at age 35 + s is given by μ [35]+s + 0.03. Allow for initial expenses of 3000 plus 25% of theirst premium, and renewal expenses of 3% of the second and subsequent premiums. use an interest

![]() rate 5% per year and the value a(…)[35]:20

rate 5% per year and the value a(…)[35]:20 ![]() j = 12.022, where j denotes calculation at interest

j = 12.022, where j denotes calculation at interest

rate j = 0.08198. calculate the annual premium. [10 marks]

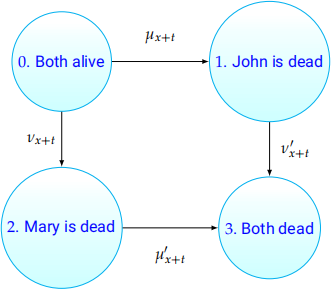

5. MuIti-Iife insurance. John and Mary, a married couple, buy a combined life insurance and pension policy specifying that premiums are payable at rate π as long as both are alive. pension is payable at rate b as long as Mary survives John and a beneit S to their dependants is due upon the death of John if Mary is already dead. The interest rate is denoted by r and the policy terminates at time n. The relevant Markov model is summarized in the picture below:

(a) Give the expressions of the transition probabilities p0i (0, t) for alli e {0, 1, 2, 3} and all t e [0, n]. [5 marks]

(b) provide Thiele,s differential equations for the reserves vi(t) for all states i = 0, 1, 2, 3, together with the corresponding boundary conditions. [4 marks]

(c) consider a modiied contract under which 50% of the reserves is paid to John in case of Mary,s earlier death before time n. provide Thiele,s differential equations for the reserves under the new contract. [6 marks]

(d) The insurance company faces administration expenses that depend partly on the reserves. Assume that those expenses incur with a rate that is a times the current reserve over the entire period of the policy [0, n]. Describe how the Thiele,s differential equations in question (b) change. [5 marks]

[Total=20 marks]

6. surpIus. An insurer is offering 30 year endowment assurance policies to lives aged 30. The sum of 200000 is payable at the end of the policy or at earlier death. The policies are inanced by a continuous premium payable throughout. The policies might lapse at any time with a force 0.01 (the policyholder decides not to pay any more premiums). Should that happen during theirst 20 years the company imposes a charge of 5% on the reserve and uses the remainder as a single premium for a pure endowment assurance payable at time 30. If the policy lapses during the last 10 years the charge is not applicable, so the whole reserve is used to inance the pure endowment. In either case there is no death beneit.

(a) using a force of interest of 0.05, set up and solve the Thiele ODE for the reserves and use the terminal condition to provide an equation for the continuous premium π . Note that you are not asked to solve that equation. [6 marks]

(b) provide expressions for the reserve at all times and states. [4 marks]

(c) provide an expression (in terms of the survival function tpx and of the annuity a(-)x:30 ![]()

at interest rate 0.01) for the probability that a policyholder will get nothing at all. [5 marks]

[Total=15 marks]

7. unit-Iinked fund. An ofice issues 20-year unit-linked endowment assurance policies to lives aged 20. The policies are inanced by a premium π0 paid upfront.

At anytime t = 0, half of the premium is invested in a unit fund which grows at a constant force of interest r. The remaining half is allocated to a cash fundata null force of interest r* = 0.

At time t = 20 or on earlier death the policyholder will receive the accumulated amount of the fund or a guaranteed sumb = 1, whichever is larger.

There is also the possibility of surrenders which occur independently of deaths and with aconstant intensity δ > 0. Surrenders are entitled to their share of the unit fund (without guarantees) but not to any of the cash fund.

(a) write down and solve the differential equations (with the right boundary conditions) satisied by the value u(t) of the unit fund. [4 marks]

(b) write down and solve in integral form the differential equation (with the right boundary condition) satisied by the value V(t) of the cash fund. [9 marks]

(c) using the equivalence principle, set an equation for the premium π0. Notice that you are not asked to solve explicitly the equation. [7 marks]

[Total=20 marks]

2023-08-15