ECO00056M Fixed Income Securities MSc Degree Examinations 2021–22

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ECO00056M

MSc Degree Examinations 2021–22

Economics

Fixed Income Securities

Answer any THREE questions

1.

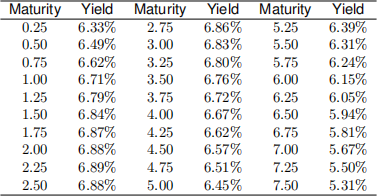

(a) Using the semiannually compounded yield curve in the table:

Price the following securities:

• 6.5 −year zero coupon bond

• 2 1/4 −year coupon bond paying 8% semiannually

• 7.5 −year floating rate bond with zero spread and semiannual payments

• 5 1/2 −year floating rate bond with 40 basis point spread with semiannual payments.

(b) Using the data from (a) find the current 2 −year semiannual swap rate.

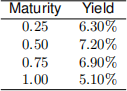

(c) Suppose that you from the observed market prices you bootstrap the following continuously compounded yield curve:

Ignore any trading costs. Can you say if there are any arbitrage opportunities in the market? Explain.

(d) Today you notice that forward rates are below the spot rate. What shape must the yield curve have? Explain.

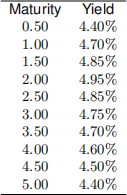

2. You observe the following continuously compounded yield curve:

(a) Find the price, duration and convexity of the 5 −year bond paying 5% semiannually.

(b) You want to hedge the coupon bond from (a) against parallel shifts in interest rates using the

3 −year floating rate bond paying 60 basis point spread semiannually that can be obtained at no cost from the repo dealer. Find the optimal number of the floating rate bonds that you need to buy or sell to hedge the duration risk only in the coupon bond.

(c) Suppose that you want to extend your hedging strategy considered in (b) by hedging also the

convexity risk with the 5 −year zero coupon bond. Find the optimal position in the 3 −year floating rate bond with spread and the 5 −year zero coupon bonds for this hedge.

3. On September 15, 2021 you enter into a 1 −year forward rate agreement (FRA) with a bank for the period starting March 15, 2022 to September 15, 2022. You know that currently the price of the

6 − month zero coupon is $96.79 and the price of the 1 −year zero coupon is $93.51.

(a) What is the (semiannually compounded) agreed-upon forward rate in the transaction?

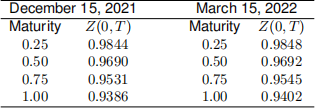

(b) Three months later (December 15, 2021) you have second thoughts and consider that maybe you should get out of the transaction. You receive the data in the first two columns of the following table:

What is the value of the FRA on December 15, 2021?

(c) Consider now March 15, 2022 from the above table.

• What is the value of the FRA now?

• What is the 6 − month semiannual rate?

• What will the balance to be paid beat the end of the FRA?

4.

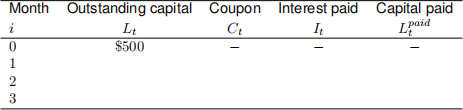

(a) Consider a $500 (thousand) mortgage for 3 months at the mortgage rater![]() 12(m) = 7%. Complete the following table:

12(m) = 7%. Complete the following table:

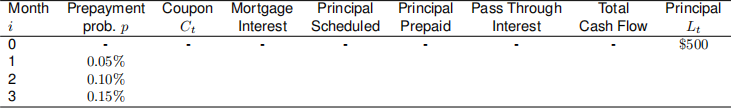

(b) Consider the MBS pass-through on 1, 000 identical mortgages as described in (a). The

pass-through security pays a coupon equal to 6%. Fill in the data on the following table using the information on the prepayment probabilities:

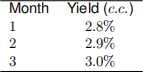

(c) You know that the continuously compounded Treasury yields for are as follows:

Use this information to price the pass-through described in (b).

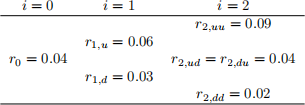

5. Consider the interest rate tree evolving as follows:

Assume that each interval of time represents 1 year. All entries are continuously compounded interest rates. You do not know what is the risk neutral probability of moving up the tree but you know that a

2 −year zero coupon bond costs Z(0, 2) = 91.5860.

(a) Find the risk neutral probability of moving up the tree.

(b) Compute the tree corresponding to the evolutions of the price of a 3 −year zero coupon bond.

(c) You know that the real-world probability of moving up the tree is q = 0.3. At time i = 0, what is investor’s 1 −year expected return on:

• the 2 −year zero coupon bond?

• the 3 −year zero coupon bond?

2023-07-29