ACFI3308 Financial Econometrics

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Financial Econometrics

ACFI3308

Assessment Information – What you need to do

BACKGROUND

You are the Investment Analyst at FH Capital, a boutique investment firm. You are tasked to create an equity fund and analyse its return and risk (volatility) characteristics.

The terms of reference are detailed below.

PART ONE: CONSTRUCTING THE EQUITY FUND

(i) Construct an equity fund “FH Equity Fund” composed of 10 to 15 equities listed on the New York Stock Exchange and/or NASDAQ.

(ii) Your stock picking should be underpinned by a sound investment strategy (such as growth, value, index, dividend growth, contrarian investing strategy etc.)

(iii) Briefly discuss your investment strategy and support it with economic theory and references.

(iv) Collect the daily price series for the equities in your fund from January 2010 to December 2020 and estimate the daily return series for the fund.

(v) Assign equal weights to all the equities in your portfolio and set the rebalance at monthly. For instance, if you have 12 stocks, the weight of each stock will be 1/12 = 0.083]

[TOTAL 15 MARKS]

PART TWO: STOCK RETURN PREDICTABILITY

UNIVARIATE TIME SERIES MODELS

Using the daily returns of the fund for the period 1 January 2014 to 31 December 2017:

(i) Estimate an appropriate Autoregressive Moving Average (ARMA) for the daily return series of your fund.

(ii) Discuss the diagnostic results (residual analysis) of the ARMA model results.

(iii) Produce an out-of-sample forecast for the next two years(1 January 2018 to 31 December 2019).

(iv) Compare your forecasts to the return series for the forecast window, using the following measures:

• Mean Square Error (MSE)

• Root Mean Square Error (RMSE), and

• Mean Absolute Percentage Error (MAPE).

[15 MARKS]

EXPONENTIAL SMOOTHING & TECHNICAL ANALYSIS

(i) Estimate an appropriate exponential smoothing (ETS) model for the daily price series for the period 1 January 2014 to 31 December 2017. Your model should incorporate a trend term and a dampening factor if required.

(ii) Produce an out-of-sample forecast for the last two years (1 January 2018 – 31 December 2019) and discuss the forecasts’ accuracy measures.

(iii) Construct a moving average convergence divergence (MACD) for the daily price series of any two stocks in your fund and the S&P 500 Index for the period 1 January 2014 to 31 December 2018. Set the parameters for the MACD at; s = 8, l = 30 and k = 9.

(iv) Analyse the predictability of the price series’ trend and momentum from the MACD plots and highlight when the chart correctly predicts (or misses) the trend and momentum in the series.

[15 MARKS]

DISCUSSION OF RESULTS

With reference to your ARMA/ETS and technical analysis, discuss the predictability of stock prices. Relate your discussion to the notion that financial markets are informationally efficient.

[10 MARKS]

[TOTAL 40 MARKS]

PART THREE: VOLATILITY MODELLING WITH GARCH

In addition to the return on the fund, it is important to understand how volatile the fund is relative to the market.

(i) Using the daily returns (in percentages) from 1 January 2014 to 31 December 2018, estimate the GARCH (1, 1) and the GJR GARCH (1, 1) process for;

• The S&P 500 index

• The equity fund you formed in Part 1

• Any two (2) stocks from the equity fund in Part 1.

(ii) Plot your volatility estimates and summarise the coefficients from your GARCH (1, 1) and GJR GARCH (1,1) models in an appropriate table and comment upon the results.

[6 MARKS]

(iii) What do the results for GARCH (1, 1) suggest about the riskiness of your fund and stocks relative to the market portfolio? Discuss.

[7 MARKS]

(iv) Using the GJR GARCH (1,1) results, discuss whether your volatility estimates are symmetrical or not. Is this result in line with the economic theory of investor reaction to good and bad news?

[7 MARKS]

[TOTAL 20 MARKS]

PART FOUR: VECTOR AUTOREGRESSIVE MODELS/COINTEGRATION

CHOOSE ONLY ONE QUESTION FROM THIS SECTION

QUESTION ONE: VECTOR AUTOREGRESSIVE MODELS(VAR)

Using the relevant quarterly series from January 2010 to December 2020:

(i) Estimate a vector autoregressive model (VAR) using the following series.

• The equity fund’s return series (from Part One)

• Real Gross Domestic Product [GDPC1]

• Industrial Output [INDPRO]

• Consumer price index [USACPIALLMINMEI]

• Federal fund effective rate [FEDFUNDS]

• Yield spreads (difference between the US 3 months T-Bill and 10-Year Treasury Constant Maturity Rate) [T10Y3M]

• SP 500 Index [^GSPC]

Note: the labels in the square bracket [ ] are the variable names in the Federal Reserve Economic Database (FRED), except for SP500 which is the variable in Yahoo Finance.

(ii) Report the following results using appropriate tables and charts:

• Granger causality between your fund’s return and all the variables in the model [ignoring all other causality results]

• Impulse response function from all other factors to your fund’s return series [ignoring all other impulse response function results].

(iii) Discuss the Granger causality results and impulse response function on the fund return series only.

[10 MARKS]

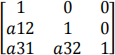

(iv) Estimate a structural VAR (SVAR) using the ordering and the restrictions below.

• Variable order Real Gross Domestic Product [GDPC1], SP 500 Index [^GSPC], The equity fund’s return series (from Part One).

• Restriction

Note: In the estimation, the ordering above Real GDP, SP 500 Index, and the fund’s return series must be maintained.

(v) Estimate the Granger Causality between the fund’s returns, Real GDP, and SP 500 Index.

(vi) Conduct an impulse response from Real GDP and SP 500 and the lag of the fund’s return series.

[10 MARKS]

[TOTAL 20 MARKS]

QUESTION TWO: COINTEGRATION AND ERROR CORRECTION MODEL

(i) Pair the following five major stock indices and test for cointegration among the pairs of variables by applying the Engle-Granger (EG) approach. Discuss whether any of the markets are cointegrated.

• FTSE 100 index

• SP 500 index

• DAX 40 index

• CAC 40 index

• Nikkei 225 index

[10 marks]

(ii) Estimate an error correction model for the cointegrated variables and discuss your results.

[10 marks]

[TOTAL 20 MARKS]

FORMAT OF THE REPORT

An R script showing the codes used in estimating your results should be submitted for all estimations.

[Link for submitting the R Script is provided below]

[2 marks]

A well-structured report with clarity of discussion, logical presentation, and proficient level of depth (references).

[3 marks]

[TOTAL 5 MARKS]

Criteria for Assessment - How you will be marked

PART ONE: CONSTRUCTING THE EQUITY FUND

[15 MARKS]

PART TWO: STOCK RETURN PREDICTABILITY

• Univariate time series models [15 marks]

• Exponential Smoothing & Technical analysis

[15 marks]

• Discussion of Results [10 marks]

[40 MARKS]

PART THREE: VOLATILITY MODELLING WITH GARCH

• Estimation and summary of GARCH (1, 1) and GJR GARCH (1, 1) [6 marks]

• Discussion of GARCH (1, 1) results [7 marks]

• Discussion of GJR GARCH (1, 1) [7 marks]

[20 MARKS]

PART FOUR: VECTOR AUTOREGRESSIVE MODELS/COINTEGRATION

• Estimation and Discussion of VAR results [10 marks]

• Estimation and Discussion of SVAR results [10 marks]

[20 MARKS]

PART FOUR: COINTEGRATION AND ERROR CORRECTION MODELS

• Test of cointegration and discussion of results [10 marks]

• Error Correction model and discussion of results [10 marks]

[20 MARKS]

FORMAT OF THE REPORT

• R script [2 marks]

• Structure of report and references [3 marks]

[5 MARKS]

There should be emphasis on logical flow and clarity of your report. Every step should be explained to engage the reader.

Students who just paste output without providing any context will get the minimum score.

ASSESSMENT AND MARKING SCHEME

The marks will be given to students that produce evidence of:

• Good understanding of the underlying theory and concepts.

• Good understanding of econometric analysis.

• Ability to link properly the first two points above

• Critical thinking in the interpretation of the findings.

This assignment is designed to assess the following learning outcomes:

(i) Appraise the problems of non-stationarity in the data series and how these problems can be detected using unit roots and cointegration tests.

(ii) Produce forecasts or ARMA and exponential smoothing models and evaluate the usefulness, relative advantages and disadvantages of VAR, ARCH and GARCH modelling using econometrics packages.

(iii) Perform and appraise business and economic forecasts using various econometrics techniques.

Assessment Details

1. The assignment must be word-processed.

2. The whole assignment must be no more than 1250 words in length including any, GRAPHICS BUT NOT REFERENCES. The word count must be stated at the end of the assignment.

3. The word limit includes tables, figures, quotations and citations, but excludes the references list and appendices.

4. Your Word file MUST be submitted to Turnitin via Blackboard provided on the module page.

5. All R Script and data must be saved using your p number submitted through the OneDrive link on Blackboard or below.

R SCRIPT SUBMISSION LINK

5. The assessment criteria detailed above will be used to mark your assignment. Please bear the criteria in mind when preparing your assignment.

6. The assignment is worth 60% of the total module mark.

7. There will be a penalty of a deduction of 10% of the mark for work exceeding the word limit by 10% or more.

How to Submit your Assessment

The assessment must be submitted by 12:00 noon (GMT/BST) on 27 April 2023. No paper copies are required. You can access the submission link through the module web.

• Your coursework will be given a zero mark if you do not submit a copy through Turnitin. Please take care to ensure that you have fully submitted your work.

• Please ensure that you have submitted your work using the correct file format, unreadable files will receive a mark of zero. The Faculty accepts Microsoft Office and PDF documents unless otherwise advised by the module leader.

• All work submitted after the submission deadline without a valid and approved reason will be subject to the University regulations on late submissions.

o If an assessment is submitted up to 14 days (about 2 weeks) late the mark for the work will be capped at the pass mark of 40 per cent for undergraduate modules or 50 per cent for postgraduate modules

o If an assessment is submitted beyond 14 calendar days late the work will receive a mark of zero per cent

o The above applies to a student’s first attempt at the assessment. If work submitted as a reassessment of a previously failed assessment task is submitted later than the deadline the work will immediately be given a mark of zero per cent

o If an assessment which is marked as pass/fail rather than given a percentage mark is submitted later than the deadline, the work will immediately be marked as a fail

• The University wants you to do your best. However, we know that sometimes events happen which mean that you cannot submit your coursework by the deadline – these events should be beyond your control and not easy to predict. If this happens, you can apply for an extension to your deadline for up to two weeks, or if you need longer, you can apply for a deferral, which takes you to the next assessment period (for example, to the re-sit period following the main Assessment Boards). You must apply before the deadline. You will find information about applying for extensions and deferrals here.

• Students MUST keep a copy and/or an electronic file of their assignment.

• Checks will be made on your work using anti-plagiarism software and approved plagiarism checking websites.

2023-07-29