ECON1210 Introductory Microeconomics Final Examination May 15, 2022

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ECON1210 Introductory Microeconomics

Final Examination

Date: May 15, 2022, 14:30-15:30 (+ 15 minutes of grace period)

1. My university ID number is [ Answer01 ].

2. The equations below show Calvin’s estimated per-month benefit of watching n movies on an online movie platform. (Assume that n can take only integer values.)

Total benefit (dollars): T B(n) = 425n − 7n 2

Marginal benefit (dollars): MB(n) = 425 − 14n

Average benefit (dollars): AB(n) = 425 − 7n

Upon paying a monthly subscription fee of 45 dollars, Calvin will be eligible to watch any movie at P dollars per movie. If Calvin decides to watch 28 movies per month under the scheme, then we can infer that the price per movie (P) is less than or equal to [ Answer02A ] dollars and more than [ Answer02B ] dollars.

3. Ken is planning on how many economics and finance courses to take in his undergraduate years. He is free to allocate 15 courses among these two areas. Assume that the number of courses is perfectly divisible (e.g. 3.14 courses). Ken’s benefits from taking economics and finance courses are:

Average benefit of taking economics courses: AB(n) = 170 − 1.5n

Marginal benefit of taking economics courses: MB(n) = 170 − 3n

Average benefiit of taking finance courses: AB(m) = 280 − 2m

Marginal benefifit of taking finance courses: MB(m) = 280 − 4m

where n and m are the number of economics courses and the number of finance courses respectively. We predict that Ken would take [ Answer03A ] economics courses and [ Answer03B ] finance courses.

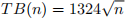

4. Consider Harris’s decision on the number of camping trips in a year. Suppose Harris’s total benefit (in dollars) from n camping trips in the coming year can be described by the following function:

For example, the total benefit of 4 camping trips is 1324^4 = 2648 dollars. Suppose, at the beginning

of every year, he has to spend 500 dollars to refurbish his camping gear, and the cost (transportation, etc.) is 175 dollars per trip. Based on this information, we expect Harris to do [ Answer04 ] camping trips in the coming year. (Assume that the number of camping trips can only be integers.)

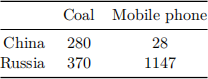

5. China and Russia both can produce coal and mobile phone. The table below shows their productivity (units of the goods per month).

Suppose China and Russia fully specialize and trade according to the principle of comparative advantages. We might conclude that the best term of trade that Russia can reasonably ask for is [ Answer05 ] unit(s) of mobile phone per unit of coal.

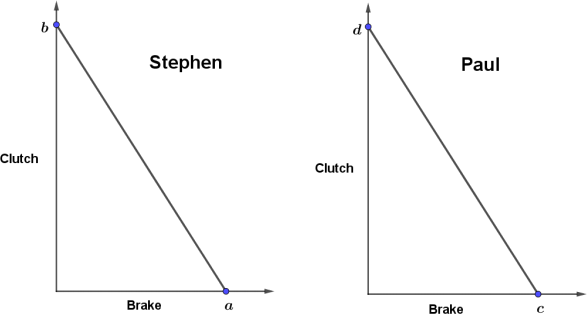

Consider the following individual production possibilities curves for Stephen and Paul to perform clutch and brake replacements (not drawn to scale), where a = 234, b = 468, c = 234, d = 117.

6. If one standard maintenance service includes one clutch replacement and two brake replacement, if they work separately, they can perform in total [ Answer06 ] standard maintenance services (can be non-integer).

7. Continue with the previous question, if they work together, they can perform in total [ Answer07 ] PERCENT MORE standard maintenance services than working separately.

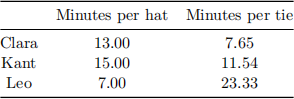

8. Clara, Kant, and Leo can produce hats and ties. The table below shows their time required to produce a hat and their time required to produce a tie (in minutes).

Assume each of them works ten hours per day. If they decide to jointly produce a total of 69 hats, they can produce a maximum of [ Answer08 ] ties in a day. (Assume that production quantity can take non-integer values.)

There are two groups of consumers, A and B, for good X with the following demand relations respectively:

Group A: P = 677 u 0.4Q

Group B: P = 723 u 0.1Q

The market supply is

P = 338.5 + 0.4Q

where P is price per unit of good X (in dollars), and Q is quantity of good X.

9. Suppose the market is free of government intervention. We can compute that the market equilibrium price is [ Answer09A ] dollars per unit, and the market equilibrium quantity is [ Answer09B ] units.

10. Suppose for national security reason, the central planner forces the economy to reduce the production of good X by 50% of the market equilibrium level. We will expect a welfare loss of [ Answer10 ] dollars when compared to the market without intervention.

11. How many of the following statements is(are) correct?

(i) The demand curve of an inferior good can be upward sloping.

(ii) Consider an inferior good X. If the price of its substitute (good Y) rises, the demand curve of X will shift rightward.

(iii) Consumer surplus equals additional units demanded beyond what sellers produce at a price.

(iv) In a perfectly competitive market with positive external benefit (but zero external cost), the social optimum does not occur at the point where excess demand and excess supply are both exactly zero.

A) 0

B) 1

C) 2

D) 3

E) 4

[ Answer11 ]

12. Consider downward-sloping demand curve and upward-sloping supply curve and initial positive equilibrium price and quantity. Assume initially there is no government intervention of any kind (e.g., tax, subsidy, price ceiling and price floor). How many of the following statements is(are) correct?

(i) A rightward shift in demand raises total consumer surplus.

(ii) A rightward shift in supply raises seller’s total revenue if demand is price inelastic over the relevant price range.

(iii) A leftward shift in supply reduces total producer surplus.

(iv) Establishing a price floor above the market equilibrium price will always reduce the sellers’ revenue.

A) 0

B) 1

C) 2

D) 3

E) 4

[ Answer12 ]

13. How many of the following statements is(are) correct?

(i) We would expect the supply of ivory to be more price elastic than the supply of Coca Cola.

(ii) If the income elasticity of demand for good X and Y is -0.2, X is an inferior good.

(iii) Driver Jerry says, “I’d like to spend an expenditure of $10 on gas no matter what.” We infer that Jerry’s price elasticity of demand for gas is negative infinity.

(iv) If the price elasticity of demand for good X is −1, then when the price of the product rises a little, total revenue to sellers increases.

A) 0

B) 1

C) 2

D) 3

E) 4

[ Answer13 ]

14. Assume linear downward-sloping demand curve and linear upward-sloping supply curve (if any), how many of the following statements about price elasticities is(are) correct?

(i) The demand curve with a slope of -0.25 is price elastic at the price-quantity pair of (P=60, Q=10).

(ii) The supply curve is price inelastic when it is steep enough.

(iii) For a supply curve with a positive y-intercept, when the price is high enough, the price elasticity of supply is close to 0.

(iv) A monopoly facing a relatively more elastic demand curve is more likely to charge a higher price.

A) 0

B) 1

C) 2

D) 3

E) 4

[ Answer14 ]

At the initial equilibrium, the price of oil is 68 dollars per barrel and the quantity is 12000 barrels per day.

The price elasticity of demand for oil is u0.3 and the price elasticity of supply is 1.51. Because of a recent oil discovery, quantity supplied is expected to increase by 480 barrels per day at any given price.

15. Given this information, we predict that the equilibrium price will [ Answer15A ] (A. increase, B. decrease) by [ Answer15B ]%.

16. In addition, we predict that the equilibrium quantity will [ Answer16A ] (A. increase, B. decrease) by [ Answer16B ]%.

The demand for good x satisfies the following relation (where “ln” is natural logarithmic function):

ln Qx = 12 u 1.3 - ln Px + 1.9 - (Pu)−2 u 1.9 - ln(income).

17. Based on the information above, x is a(n) good; x and y are .

A) normal; substitutes

B) normal; complements

C) inferior; substitutes

D) inferior; complements

[ Answer17 ]

18. The price elasticity of demand for good x is [ Answer18A ] and the income elasticity of demand for good x is [ Answer18B ].

19. The market demand curve for alcohol is P = 490 u 35Q (where P is price per alcohol in dollars, and Q is quantity of alcohol in bottles) and the marginal cost of supplying alcohol is constant at $325 per bottle. Then the government’s tax revenue is maximized when it imposes a per-bottle tax of $ [ Answer19 ] on alcohol.

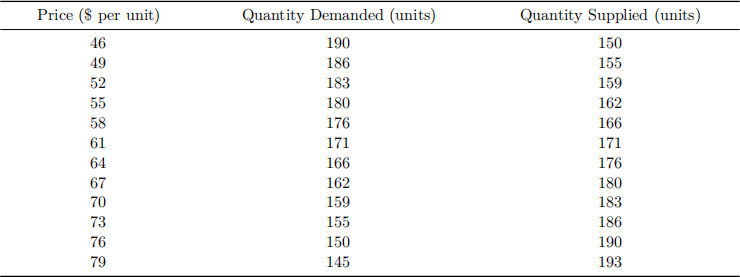

Consider the following supply and demand schedule of potato chips.

20. Suppose initially the potato chips market is in an unregulated equilibrium. If the government imposes a subsidy of $6 for each unit of the potato chips sold, at the new equilibrium, the price received by the sellers will be $[ Answer20 ] per unit.

Suppose a per-unit subsidy is introduced on a product which is characterized by linear downward-sloping demand curve and linear upward-sloping supply curve. The subsidy raises the consumer surplus by $8252 and raises the producer surplus by $4405. The deadweight loss is $2057.

21. The government subsidy expenditure is $[ Answer21 ] at the equilibrium.

22. Suppose we also know that the subsidy rate is $26 per unit. We can conclude that the subsidy raises the quantity transacted from [ Answer22A ] units to [ Answer22B ] units.

(i) If the government imposes a subsidy of 1 dollar for each gallon of gasoline, at equilibrium, the price of gasoline paid by the buyers increases.

(ii) For the same amount of subsidy per unit imposed, deadweight loss is higher when the demand and/or supply is less price elastic.

(iii) When a per-unit tax is imposed, the decrease in total economic surplus received by consumers and producers is always less than the increase in tax revenue received by the government.

(iv) Consider a per-unit tax, if sellers are less price elastic than buyers, buyers will bear less burden of the tax.

A) 0

B) 1

C) 2

D) 3

E) 4

[ Answer23 ]

Given a price P in dollars per hour, the demand and supply for child care services (in thousand hours per year) in Utopia are given by the equations:

Demand: Q = 1460 − 5P thousand hours

Supply: Q = 20P − 100 thousand hours

In unregulated market equilibrium, the price is P = 62.4 dollars per hour and the quantity is Q = 1148 thousand hours.

24. Suppose the government would like to raise the usage of child care services by 140 thousand hours by a per-hour subsidy. The subsidy should be [ Answer24 ] dollars per hour.

25. Instead of a subsidy, due to political pressure, the government decides to set a price floor of f dollars per hour on child care service. The government would like to limit the lost gains from trade due to the price floor to 19200 thousand dollars per year. The maximum value of f is [ Answer25 ].

(Assume all consumption are allocated to consumers with the highest valuation and all production are allocated to producers with the lowest cost of production.)

The residents of Utopia have complained to the government that the medical service charge in hospitals is too high. The administration promises to consider two policies proposed by the representatives of the residents: (1) a price ceiling, and (2) a medical service subsidy. Assume that the government can implement only one policy for two years in Utopia. The market demand and supply curves of medical service are given below:

Demand: Q = 830 − 1. 5P + 20 × pop thousand visits per year

Supply: Q = 2.5P − 240 thousand visits per year

where P is the price per medical visit (in dollars), Q is the quantity of medical visits (in thousand visits), pop is the population of Utopia (in million).

26. In the first year, suppose there are 6.5 million people in Utopia. The unregulated market equilibrium medical service charge is [ Answer26A ] dollars per visit, and equilibrium number of medical visits is [ Answer26B ] thousand visits per year.

27. Continue with the previous question. Consider a price ceiling on medical service charge at 180 dollars per visit, there will be a shortage of [ Answer27 ] thousand visits per year.

28. Continue with the previous question. At the proposed price ceiling, suppose the medical services are automatically rationed to the highest-valuation consumers. The consumer surplus will be [ Answer28A ] thousand dollars per year, and the deadweight loss will be [ Answer28B ] thousand dollars per year.

29. Continue with the previous question. Now consider the policy of subsidizing medical service charge instead. In order to reduce the effective price consumers have to pay to the level of 180 dollars per medical visit, the government needs to introduce a subsidy of [ Answer29 ] dollars per medical visit.

30. Continue with the previous question. With the above subsidy policy, the deadweight loss will be [ Answer30 ] thousand dollars per year.

31. In the second year, suppose there are 8.5 million people in Utopia. Suppose that the price ceiling

remains unchanged at 180 dollars per visit. If the government implements the price ceiling policy, the deadweight loss will be [ Answer31 ] thousand dollars in the second year. (Continue to assume that medical services are automatically rationed to the highest-valuation consumers.)

32. Continue with the previous question. Suppose instead the government implements the subsidy policy, and the medical service subsidy rate remains to be at the level that you calculated for the first year earlier. In the second year, given this subsidy rate, the deadweight loss will be [ Answer32 ] thousand dollars.

33. Standing at the beginning of the first year, if the government’s sole objective is to minimize sum of deadweight losses in the first and second years, it should choose the ________ policy. And this policy is ________ than the case without any policy intervention from the government’s perspective.

A) price ceiling; strictly better

B) price ceiling; strictly worse

C) medical service subsidy; strictly better

D) medical service subsidy; strictly worse

[ Answer33 ]

The market demand and supply of casino service are described by the following equations.

Demand: P = 845 − 0.3Q dollars per unit of casino service

Supply: P = 0.2Q + 220 dollars per unit of casino service

Because of the health problems associated with gambling, for each unit of casino service produced, an external cost of 240 dollars is generated. On the other hand, because of the positive spillover effect to the economy, the marginal external benefit is 0.15Q + 240 dollars when Q units of casino services are consumed.

34. From the information, the unregulated market equilibrium price is [ Answer34A ] dollars per unit of casino service and equilibrium quantity is [ Answer34B ] units of casino service.

35. The total economic welfare to the society at the market equilibrium level of casino service is [ Answer35 ] dollars.

36. The socially efficient quantity of casino service is [ Answer36 ] units.

37. Without any government intervention, the welfare loss to the society will be [ Answer37 ] dollars when compared to the socially efficient outcome.

38. In order to induce the market to produce at the socially efficient quantity, it is optimal for the government to impose a [ Answer38A ] ( A. tax; B. subsidy; C. price ceiling; D. price floor ) of [ Answer38B ] dollars per unit of casino service.

Factory X is located in the upstream of a river and the villagers live in the downstream of the river. Factory X is selecting between two sewage treatment technologies, A and B. The following table shows the gains to Factory X and the amount of sewage damage to villagers corresponding to each technology.

39. It is socially efficient for Factory X to adopt technology [ Answer39 ].

40. Suppose negotiation costs are negligible. If Factory X is not liable for the sewage damage, technology [ Answer40A ] will be chosen eventually. If Factory X is fully liable for the sewage damage, technology [ Answer40B ] will be chosen eventually.

41. If Factory X is not liable for the sewage damage and it costs $48 to the villagers to hire a lawyer and negotiate with Factory X, technology [ Answer41A ] will be chosen eventually. If Factory X is fully liable for the sewage damage and it costs $48 to Factory X to hire a lawyer and negotiate with the villagers, technology [ Answer41B ] will be chosen eventually.

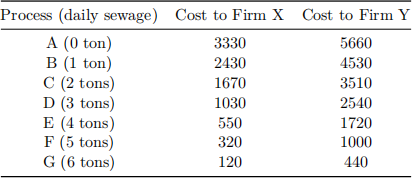

Two firms, X and Y, have access to seven different production processes, each one of which has a different

cost (in dollars) and gives off a different amount of sewage (in tons). The information is summarized in the table below.

42. If pollution is unregulated, and negotiation between the firms and their victims is impossible, firm X will use the production process [ Answer42A ], firm Y will use the production process [ Answer42B ], and the total sewage dischrage will be [ Answer42C ] tons per day.

43. Suppose initially there is no regulation on pollution, and the city council has recently decided to cut the total sewage discharge by two-third. If the city council commands each firm to cut its sewage discharge by two-third, the total cost of pollution control to the society will be [ Answer43 ] dollars per day.

44. Continue to assume that the city council wants to cut total sewage discharge by two-third. Suppose the city council like to set a tax of T dollars on each ton of sewage discharged each day. To achieve the desired reduction in total sewage discharge, T should be greater than [ Answer44A ] and less than [ Answer44B ].

45. Continue from the previous question. Using tax as a tool to cut total sewage discharge by two-third, the total cost of pollution control to the society is [ Answer45A ] dollars per day. The government can collect a daily revenue of at least [ Answer45B ] dollars from taxation.

46. Suppose instead of commanding or taxation, the city council wants to cut total sewage discharge by two-third using pollution permits. One pollution permit will allow the firm to generate one ton of sewage discharge per day. Suppose the government sets each pollution permit at a price of P dollars and allows the firms to buy as many permits as they want to. For the two firms to end up buying a total of four pollution permits from the government each day so that total sewage discharge can be cut by two-third, P should be greater than [ Answer46A ] and less than [ Answer46B ].

47. Continue from the previous question. Using pollution permit as a tool to cut total sewage discharge by two-third, the total cost of pollution control to the society is [ Answer47A ] dollars per day. The government can collect a daily revenue of at least [ Answer47B ] dollars from selling pollution permits.

A small village consisting of 200 villagers is located next to a small forest. Every month, each villager is endowed with one unit of time. Each month, each villager can either choose to use the one unit of time to

participate in village work and earn 460 dollars, or to cut down a tree in the forest and sell it to the market.

If n trees are supplied to the market, the price for each tree will be 3550 u 20n dollars (n can only take integer values).

48. If the villagers make their decisions individually, we would expect [ Answer48 ] trees to be cut down each month in equilibrium.

49. From the society’s perspective, to maximize village’s total income, the optimal number of trees to be cut down each month is [ Answer49 ] units.

50. The government wants to impose a per-unit tax of T dollars per tree sold in the market so as to induce the socially optimal number of trees being cut down each month. T should be greater than [ Answer50A ] and less than [ Answer50B ].

51. Suppose any policy (such as per-unit tax on trees sold) to regulate tree-cutting involves an implemen- tation cost of C dollars per month. At its best, the government’s policy can help achieve the socially optimal number of tree-cutting. From the society’s perspective, such policy should be implemented only if C is less than or equal to [ Answer51 ].

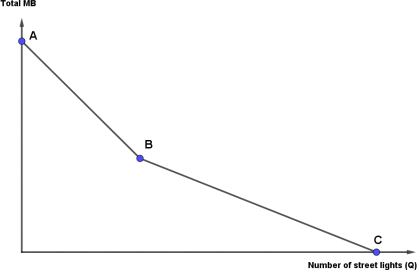

Adam and David are the only two residents in a neighborhood. Below shows their individual marginal benefits from installation of street lights in their neighborhood.

Adam: MBA = 100 − 1.5Q

David: MBD = 60 − 4.5Q

where Q is the number of street lights and MBs are measured in dollars, both of which are constrained to be non-negative. Street lights are non-rival and non-excludable in consumption. Assume that Q is perfectly divisible and can take any arbitrary quantity (say, 3.14 street lights).

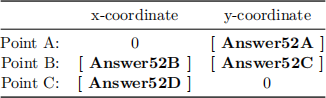

52. The total marginal benefit should look like the graph below (not to scale).

We can identify the three points as:

53. Suppose the social marginal cost of producing each street light is constant at 29 dollars. Given this information, the socially efficient number of street lights is [ Answer53 ].

54. How many of the following statements is(are) correct?

(i) Consider the case of monopoly. For a single-price monopolist facing downward-sloping demand curve (with positive profit-maximizing price-quantity pair, constant marginal cost and non-zero fixed cost), if the government sets a price ceiling at the marginal cost, the monopoly would exit the industry as soon as possible.

(ii) Consider the case of public goods. The government can implement the Clark-Groves mechanism to induce truth-telling by supplying the quantity based on a comparison of the reported willingness to pay and the marginal cost of production, and let all consumers equally share the cost of production.

(iii) Consider the case with zero external benefit but constant and positive external cost. If the amount of the tax imposed equals the marginal external cost of the activity, then the market will end up with production and consumption at the socially efficient level.

(iv) Consider the case of common resources. The tragedy of the commons refers to the tendency for any non-privately owned good to be under-used relative to the socially optimal level.

A) 0

B) 1

C) 2

D) 3

E) 4

[ Answer54 ]

55. Consider downward-sloping market demand curve and no government intervention of any form. How many of the following statements is(are) correct?

(i) Tying is a strategy where the base good is set above cost and the variable good is set below cost.

(ii) Consider a decreasing cost industry in a perfectly competitive market. Its industry long-run supply curve is downward-sloping because the short-run individual firm supply curves are downward-sloping.

(iii) For a monopoly, the marginal revenue (per additional unit of output) curve facing the firm is horizontal.

(iv) Consider a monopoly. With constant marginal cost and non-zero fixed cost, as quantity supplied increases, the average cost approaches the marginal cost.

A) 0

B) 1

C) 2

D) 3

E) 4

[ Answer55 ]

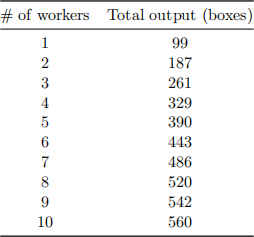

The market for pencils is perfectly competitive. Alfred’s pencil factory is one of many perfectly competitive firms. Assume that the only variable input required for production is workers. The following table shows the relationship between the number of workers hired and the total output (boxes of pencils produced per day).

Alfred pays a fixed cost of rental of $36 per day, and to each worker a wage of $85 per day. The price of pencils is $1.18 per box.

56. Given such information, in the short run, Alfred should hire [ Answer56A ] workers, and thus produce [ Answer56B ] boxes of pencils per day.

57. Consequently, in the short run, Alfred will make a daily profit of $[ Answer57 ].

Suppose the hotel industry is a perfectly competitive constant cost industry. All hotels are identical (having

the same production costs and producing the same product). The quantity of hotel service is assumed to be perfectly divisible. A typical hotel has the following total cost and marginal cost functions of hotel service:

Total Cost: TC = 50q2 + 310q + 2630 dollars

Marginal Cost: MC = 100q + 310 dollars

where q is quantity of hotel service (in units) produced by a typical hotel.

58. The shut-down price for a typical hotel is [ Answer58 ] dollars.

59. If the price is less than [ Answer59 ] dollars, a typical hotel will exit the industry as soon as possible.

60. If there are 50 hotels in the market, we conclude that the short-run supply curve of this industry is of the form (P is price per unit of hotel service in dollars, and Q is market quantity of hotel service):

P = A + B - Q

where A is equal to [ Answer60A ], and B is equal to [ Answer60B ].

61. Continue with the previous question. Suppose the market demand curve for hotel services is given as

below (P is price per unit of hotel service in dollars, and Q is market quantity of hotel service):

P = 11100 u 16.4Q dollars

At short-run equilibrium, the price is [ Answer61A ] dollars per unit of hotel service. Each hotel produces [ Answer61B ] units of s

2023-07-04