Problem set ECOS3003

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Problem set ECOS3003

Due date 23:59 22 Mar

Please keep your answers brief and concise. Excessively long and irrelevant answers will bepenalised. You can handwrite your answers if you wish.

1. Consider the following game, which has been loosely based on the trust models studied in class. For the purposes of this game, focus on pure-strategies only.

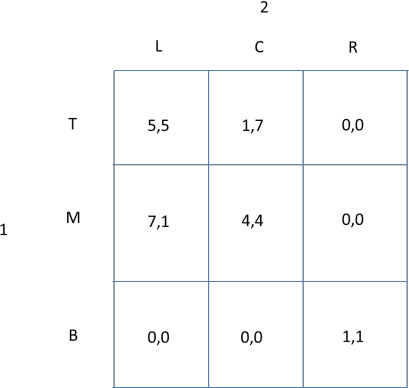

Each agent moves simultaneously. Agent 1 can take either action T, M or B, whereas Agent 2 can take actions L, C, or R.

The payoffs are shown in the following normal form game.

a. Outline and explain the Nash equilibria if the game is played once. (Again, focus only on pure-strategy equilibria.)

b. Now consider the case when the game is played twice. That is, in the first period at the firm, Agents 1 and 2 simultaneously choose their actions. Their choices are revealed before in the second period, again the agents simultaneously choose their actions. Then the game ends. There is no discounting of payoffs between periods.

Outline how, as part of a subgame equilibrium that the threat to play either B or R in the final period rather than M or C can help sustain the cooperative outcome of (T,L) in the first period. Interpret this two-period game as a trust game. Explain why ‘trust’ (or cooperation) can be achieved in the first period of this game without having to resort to an infinite-horizon game.

2. Cindy and Andy are both workers on a team. At the same time both workers can choose to work on the risky project (R) or the safe project (S). If both choose to work on the R project the payoffs are 5 to Cindy and 4 to Andy. If both work on the S project the payoffs are 4 to Cindy and 5 to Andy. If Cindy works on R and Andy on S, the payoffs are (8, 10) to Cindy and Andy respectively. Finally, if Cindy plays S and Andy plays R, the payoffs are (10, 7).

a. What are the Nash equilibria of the game? Interpret your equilibria in terms of a firm using teams.

b. Now assume that Cindy can move first and choose which project to work on. Andy observes Cindy’s choice before making his choice of either R or S. What are the subgame perfect equilibria of the game? Interpret this sequential game in terms of communication and leadership in organisations.

3. Consider the following delegation versus centralisation model of decision making, loosely based on some of the discussion in class.

A principal has to implement a decision that has to be a number between 0 and 1; that is, a decision d needs to be implemented where 0 ≤ d ≤ 1 . The difficulty for the principal is that she does not know what decision is appropriate given the current state of the economy, but she would like to implement a decision that exactly equals what is required given the state of the economy. In other words, if the economy is in state s (where 0 ≤ s ≤ 1) the principal would like to implement a decision d = s as the principal’s utility Up (or loss from the maximum possible profit) is given by

UP = − ![]() s − d

s − d![]() . With such a utility function, maximising utility really means making the loss as small as possible. For simplicity, the two possible levels of s are 0.4 and 0.7, and each occurs with probability 0.5.

. With such a utility function, maximising utility really means making the loss as small as possible. For simplicity, the two possible levels of s are 0.4 and 0.7, and each occurs with probability 0.5.

There are two division managers A and B who each have their own biases. Manager A always wants a decision of 0.4 to be implemented and incurs a disutility UA that is increasing the further from 0.4 the decision d that is actually implement, specifically, UA = − ![]() 0.4 − d

0.4 − d![]() . Similarly, Manager B always wants a decision of 0.7 to be implement, and incurs a disutility UB that is (linearly) increasing in the distance between 0.7 and the actually decision that is implemented - that is UB = −

. Similarly, Manager B always wants a decision of 0.7 to be implement, and incurs a disutility UB that is (linearly) increasing in the distance between 0.7 and the actually decision that is implemented - that is UB = − ![]() 0.7 − d

0.7 − d![]() . Each manager is completely informed, so that each of them knows exactly what the state of the economy s is.

. Each manager is completely informed, so that each of them knows exactly what the state of the economy s is.

(a) The principal can opt to centralise the decision but before making her decision – given she does not know what the state of the economy is – she asks for recommendations from her two division managers. Centralisation means that the principal commits to implement a decision that is the average of the two recommendations she received from her managers. The recommendations are sent simultaneously and cannot be less than 0 or greater than 1.

Assume that the state of the economy s = 0.7. What is the report (or recommendation) that Manager A will send if Manager B always truthfully reports s?

(b) The principal is going to centralise the decision and will ask for a recommendation from both managers, as in the previous question. Now, however, assume that both managers strategically make their recommendations. What are the recommendations rA and rB made by the Managers A and B, respectively, in a Nash equilibrium?

(c) What is the principal’s expected utility (or loss) under centralised decision making (as in part b)?

(d) Can you design a contract for both of the managers that can help the principal implement their preferred option? Why might this contract be problematic in the real world?

4. Consider a variant on the Aghion and Tirole (1997) model. Poppy, the principal, and Aiden, the agent, together can decide on implementing a new project, but both are unsure of which project is good and which is really bad. Given this, if no one is informed they will not do any project and both parties get zero. Both Poppy and Aiden can, however, put effort into discovering a good project. Poppy can put in effort E; this costs her effort cost E2 , but it gives her a probability of being informed of E. If Poppy gets her preferred project she will get a payoff of $1. For all other projects Poppy gets zero. Similarly, the agent Aiden can put in effort e at a cost of e2 ; this gives Aiden a probability of being informed with probability e. If Aiden gets his preferred project he gets $1. For all other projects he gets zero. Note also, that the probability that Poppy’s preferred project is also Aiden’s preferred project is α (this is the degree of congruence is α). It is also the case that α if Aiden chooses his preferred project that it will also be the preferred project of Poppy. (Note, in this question, we assume that α = β from the standard model studied in class.)

(a) Assume that Poppy has the legal right to decide (P-formal authority). If Poppy is uninformed she will ask the agent for a recommendation; if Aiden is informed he will recommend a project to implement. First consider the case when both Aiden and Poppy simultaneously choose their effort costs. Write out the utility or profit function for both Poppy and Aiden. Solve for the equilibrium level of E and e, and show that Poppy becomes perfectly informed (E = 1) and Aiden puts in zero effort in equilibrium (e = 0). Explain your result, possibly using a diagram of Poppy’s marginal benefit and marginal cost curves. What is Poppy’s expected profit?

(b) Now consider the case when the agent Aiden has the formal decision making rights (Delegation or A-formal authority). In this case, if Aiden is informed he will decide on the project if he is informed; if not he will ask Poppy for a recommendation. Again calculate the equilibrium levels of E and e.

(c) Consider now the case when Poppy can decide to implement a different timing sequence. Assume now that with sequential efforts first Aiden puts in effort e into finding a good project. If he is informed, Aiden implements the project he likes. If Aiden is uninformed he reveals this to Poppy, who can then decide on the level of her effort E. If Poppy is informed she then implements her preferred project. If she too is uninformed no project is implemented.

Draw the extensive form of this game and calculate the effort level Poppy makes in the subgame when the Agent is uninformed. Now calculate the effort that Aiden puts in at the first stage of the game. Calculate the expected profit of Poppy in this sequential game and show that it is equal to (1−α)α + α .

5. Design and solve a one-period game with two players who each have two possible actions. Assume the players make their respective choices of actions simultaneously. Design your game so that there are three Nash equilibria (at least). After solving the Nash equilibria of the game, interpret your game in the context of corporate culture.

2023-06-07